Archive for the ‘Uncategorized’ Category

Saturday, March 13th, 2010

Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year. Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year.

Testimony centers around proposals to raise the minimum down payment from 3.5% to 5% – and to 10% for borrowers with credit scores of 500-579. Borrowers with scores below 500 would be ineligible.

Some, citing the danger of inflated appraisals, also wish to lower a sellers’ maximum contribution to buyer’s closing costs from 6% to 3%. Mr. Charles McMillan, representing the National Association of Realtors, warned that such a move could cause a severe drop in home sales in areas of the country where home prices and closing costs are high.

Mr. McMillian also argued that credit scores are not a perfect indicator of the ability to repay a loan, and that raising the down payment to 10% for borrowers with scores below 580 will negate the intent of FHA financing – which is to serve those under-served by the private market

FHA Commissioner David H. Stevens, in an 18-page prepared speech, warned that raising the required down payment could seriously impact recovery of the housing market. According to an agency evaluation of recent loans, raising the down payment requirement would reduce the number of FHA loans by 40%.

Thus 300,000 buyers – the majority of whom were first time buyers, Hispanics, and African Americans – would not have received mortgage loans.

Instead of raising the down payment for borrowers with a minimum 580 FICO score, FHA now proposes to lower the up-front FHA mortgage insurance and increase the annual premium, which is paid monthly. At present, the up-front mortgage insurance premium is at 2.25% of the loan value and is financed into the loan balance.

This move would change the loan to value ratios, but would mean little to borrowers as they make their monthly payments – the mortgage insurance will still be an additional cost over the principal, interest, taxes and insurance included in their monthly payments.

The proposed changes are an effort to reduce risk while increasing revenues for FHA. Due to the recent mortgage crisis, FHA secondary reserves have fallen below the required 2% level. Stevens noted, however, that FHA has not been hit with the delinquencies and foreclosures that have plagued the subprime market. This is due to the fact that throughout the housing boom and the era of easy loans, FHA maintained loan standards such as requiring verification of borrower income and employment.

Eight individuals, representing various sectors of the real estate industry, presented their prepared comments – many of them conflicting and at least one citing record-keeping errors that skew the results of FHA evaluations. To read their remarks, go to http://www.house.gov/apps/list/hearing/financialsvcs_dem/hrhousing_030410.shtml

Author: Mike Clover

CreditScoreQuick.com your resource for Credit News.

Posted in Uncategorized | Comments Off

Friday, March 12th, 2010

The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing. The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing.

You’re no longer seeing tables with credit card representatives trying to lure you into making application for their cards. You’re no longer being offered pizzas, t-shirts, and teddy bears in exchange for your signature on the dotted line.

That’s because the credit card companies are no longer allowed to use these enticements – and many economists see that as a good thing.

The era of easy credit for college students has led to an average credit card debt for college students of more than $3,000. That might not seem like much for an adult earning a good income, but for a college student who is not yet earning income, it’s a hefty sum.

Some financial experts believe that lack of access to credit will force college students to budget and make wise spending choices – a good way to enter adulthood by anyone’s estimation.

But still, life does sometimes present us with emergencies, and sometimes fast credit is the only way to deal with them. What do you do if your bank account is hovering near empty, you need to drive 20 miles to class each day, and the transmission on your clunker gives out?

Having a credit card in your pocket for emergencies is a secure feeling.

So how can you get a credit card if you’re a student, under 21 years old, and you missed the February deadline? The most obvious way is to gain employment that would qualify you for your own card. But if you’re dedicated to earning a degree, employment may be out of the question right now.

The next-best way is to get a parent or guardian to co-sign. This is a risky move for them, so handle it carefully. If you use the card wisely and make all the payments on time, their credit scores will be improved. But if you max-out the card or fail to make a payment, you’ll be hurting the person who helped you.

One safeguard for your benefactor is that you won’t be able to increase the credit limit without their permission. So if they agree to co-sign for a $1,000 credit limit, you can’t increase it to $5,000.

Once you turn 21 or gain employment that would enable you to meet the payments on a credit card, you should apply for a new one under your own name. Once you have it, close the joint account and release your family from the obligation.

Author: Mike Clover

CreditScoreQuick.com your resource for credit cards, credit reports, loans and Credit News.

Posted in Uncategorized | Comments Off

Monday, March 8th, 2010

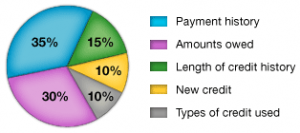

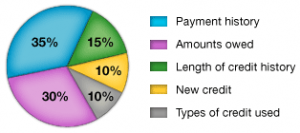

While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios. While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.

Unfortunately, in the current economy, these scenarios aren’t so much mistakes as situations/events caused by widespread unemployment and pay cuts.

Interestingly, the “Damage Points” chart shows that the higher your current credit score, the more damage will be done by one of these events.

Topping the list of most damaging to credit scores is bankruptcy. A consumer with credit scores averaging 780 or more can expect scores to drop 220-240 points, while a consumer with scores of 680 will see a drop of only 130-150 points.

Least damaging is a maxed-out credit card, hurting those with 680 scores by only 10 to 30 points, and dropping a 780 score by 25 to 40 points.

Depending upon your initial scores, a 30-day late payment will drop scores from 60 to 110 points, debt settlement will cause a drop of 45 to 125 points, and foreclosure will have an 85 to 160 point effect.

Lenders use these scores to determine your credit worthiness. In general, the higher your scores the greater your chance of getting a loan, and getting a favorable interest rate on that loan. However, credit scores are not the only criteria. Lenders also look at other details, such as your total debt to income, the length of time you’ve been on your job, and the number of dollars you have in savings.

These situations can’t really fall under the category of credit mistakes, but we know there are plenty of mistakes that can affect your credit.

For instance, the report shows the damage if you max out a credit card. What’s the damage if you use 65% of your available credit instead of staying below the recommended 30%? What’s the impact if you let a merchant or a prospective landlord run a credit check on you? How much will it hurt if you get mad at a credit card that’s raised your interest rate – and close that account? How damaging is it to not carry any credit cards?

Since we don’t know the answers to those questions, the best course of action is to use credit, but use it sparingly, and pay all bills on time. If you carry several credit cards, be sure your balances are spread out, showing that you have access to far more credit than you use on each card. And don’t let anyone check your credit until you’re sure you’re ready to make a purchase.

Finally, keep a close eye on your credit report and correct all errors promptly.

Author: Mike Clover

CreditScoreQuick.com your resource for credit reports, credit cards, loans, and Credit News.

Posted in Uncategorized | Comments Off

Monday, March 8th, 2010

Soon consumers who find errors on their credit reports will be able to request corrections directly from the merchant who reported the inaccurate information.

Previously, consumers had to report the error to the credit bureau who included it in their credit report. The credit bureau would then contact the merchant and wait for a response. Unfortunately, the method of contact made resolution difficult for merchants because the credit bureaus use a code number to describe the complaint, rather than an explanation.

This rule change by federal banking regulators was finalized in July 2009 and goes into effect July 1, 2010.

The new rules also require merchants who report information to do so with “integrity.” In this case, integrity means that they must clearly identify you and use a standardized format to convey their information. The information must include the time period to which the information refers and the credit limit on your account.

Reporting credit limits has the potential to raise consumer credit scores in the event that the consumer is using only a small portion of their available credit.

One danger to consumers is that their complaint may be disregarded as “frivolous” unless they comply with reporting requirements. So if you’re a consumer upset over an error on your credit report, don’t get angry and ramble. Instead, use this standard format:

• Provide your full name and your account number.

• Clearly state the reason for our dispute. Give the date of any transaction in dispute and explain the nature of your complaint. For instance, if they have reported a payment as late and you believe it was paid on time.

• Provide documentation to show why the report is incorrect. In the case of a late payment, provide a copy of electronic banking records or your cancelled check. If an account has been paid in full, provide a copy of a final statement as proof.

Once you have provided proper information, the merchant will have 30 days in which to investigate and get back to you. Should they fail to do so, the FTC, state attorneys general or bank regulators could potentially bring a case against them, with civil penalties of up to $3,500 per occurrence.

After an error has been verified and correction has been made, the merchant is required to send a corrected report to the credit bureau.

Considering the amount of data transmitted daily and the ease with which a typographical error can be made or a line in a report skipped, consumers with errors should not take them as a personal affront. Instead, they should take immediate action to correct the error.

The fact that over 70% of all credit reports contain errors is one reason why we believe all consumers should read their own credit reports monthly. Just one 30 day late payment can reduce credit scores from 60 to 110 points – having a serious effect on the consumer’s ability to qualify for good interest rates.

Author: Marte Cliff

CreditScoreQuick.com your resource for credit reports, credit cards, loans and Ground Breaking Credit News.

Posted in Uncategorized | Comments Off

Thursday, March 4th, 2010

Identity theft has been a problem and a concern for many years, but the current state of the economy has turned it into big business. Stealing your identity could mean big profits for those who don’t mind “earning” their living on the shady side of life. Identity theft has been a problem and a concern for many years, but the current state of the economy has turned it into big business. Stealing your identity could mean big profits for those who don’t mind “earning” their living on the shady side of life.

Small-scale crooks will steal identities one at a time, while the large-scale thieves will simply hack into a database and take thousands all at once, but the result is the same. Your name and your good credit is stolen, to be used by “a person or persons unknown.”

Identities, once stolen, may be used by the thief to make a few purchases with a credit card before moving on to the next name, or may be sold to an “end user.” And not all identities are stolen for the same reason.

Some definitely want to use your good credit to make purchases. Others want to use your identity in order to gain employment or rent a house. That’s the kind of theft you won’t even notice unless you read your credit report – or until the IRS demands to know why you haven’t declared all of your earnings on your tax return.

This very real threat to your mental and financial well-being is one reason why www.CreditScoreQuick.com brings its readers the latest information on protecting themselves from identity theft, and why they recommend services that monitor your credit report for activity on a regular basis.

Articles on site alert readers to the “red flags” of identity theft – such as a change of address or an incorrect employer listing. Other articles explain what to do when you find errors or signs of theft. Still others warn of the latest scams perpetrated by identity thieves.

For instance one of the current threats is so slick that thousands of victims have already fallen prey. It happens when consumers get a phone call supposedly originating from their credit card issuer. The caller asks if they’ve just made a specific large dollar purchase and when the consumer says no, the caller says she will deny the charge and file a report.

The caller knows the credit card number, the consumer’s address, and possibly even their Social Security number, and asks the consumer to verify all that information. Then, after some conversation and rapport-building, the caller asks the consumer to check to see if they have their credit card in their possession. And in order to verify that yes, they do, she asks for the 3 digit code on the back.

Of course the call was bogus, but now the crooks not only have the credit card number, but the 3-digit code.

So beware – and don’t give out any information over the phone!

Author: Marte Cliff

CreditScoreQuick.com your resource for credit reports, credit cards, loans and ground breaking credit news.

Posted in Uncategorized | Comments Off

Tuesday, February 23rd, 2010

February 23, 2009: Today, www.ftc.gov released an article entitled “FTC Amends Free Credit Reports Rule To Help Consumers Steer Clear of ‘Free’ Offers that Cost Money”

This report outlines the fact that consumers are entitled to a free credit report each year from the 3 major credit bureaus – there is no charge and no obligation to leave a credit card number. Consumers can simply go to AnnualCreditReport.com and get their free report.

It goes on to say that “Free Credit Report Sites” such as www.creditscorequick.com are misleading consumers because the credit report providers want them to enroll in a service that will give them access to their credit reports year-round and will alert them when there’s activity on their credit reports.

Beginning April 1, all sites offering free credit reports will be required to include the following:

THIS NOTICE IS REQUIRED BY LAW. Read more at FTC.GOV.

You have the right to a free credit report from AnnualCreditReport.com

or 877-322-8228, the ONLY authorized source under federal law.

The Web site disclosure must include a clickable button to “Take me to the authorized source” and clickable links to AnnualCreditReport.com and FTC.GOV.

That’s all well and good, but the article and the warning both fail to mention three important points.

The first is that no consumer is obligated to continue the service when they obtain a free credit report from www.creditscorequick.com or any similar website. They can get their free credit report and then cancel the service with no payment whatsoever.

The next is that the free reports from Annual Credit Report contain just the information, without analysis or credit scores. If the consumer wants to know their credit scores, they do have to pay. Since knowing your credit score is important, their free service is sadly lacking.

Finally, checking your credit report only once per year is not good financial management.

With identity theft running rampant, a consumer could find himself or herself in a financial and legal morass by the end of a year.

By checking monthly and signing up for alerts, consumers can put a fast stop on identity theft – saving themselves thousands of dollars and months of red tape. In addition, consumers who keep a close watch on their credit reports can catch and correct errors quickly. Those who wait to see their credit reports until they need to use credit are often shocked to learn that a mistake has lowered their credit score – making it impossible to obtain credit at a reasonable interest rate.

Even representatives from FICO admit that over 70% of all credit reports contain errors – and that those errors usually have a negative impact on credit scores.

And that is important. Everyone from the credit card issuer to the mortgage lender to a potential employer or a rental manager will judge a consumer on those scores. But most people don’t know what to do to improve them.

The service offered by credit report providers such as Identity Guard tells consumers the answers – giving a clear reason why a score is lower than it might be. This gives consumers the opportunity to make adjustments and raise their credit scores before they need to use credit.

Wise consumers will decide for themselves: “Is it good enough to see a credit report with no scores once a year, or is my financial future important enough for me to keep a close eye on my credit from month to month.”

Author: Marte Cliff

CreditScoreQuick.com your resource for credit reports, credit cards, loans and credit news.

Posted in Uncategorized | Comments Off

Sunday, February 21st, 2010

Having bad credit can be a nightmare. Especially if you don’t have any money saved. You might find yourself in need of a loan, which will require use of your credit. I assure you that there will be a point in your life where your credit will be required of you. It is quite possible that you are in this very predicament now. All of us have read that everyone is pulling our credit reports to see our credit history. Your credit report can be quite violating, kind of like being in front of a crowd with no clothes on. Having bad credit can be a nightmare. Especially if you don’t have any money saved. You might find yourself in need of a loan, which will require use of your credit. I assure you that there will be a point in your life where your credit will be required of you. It is quite possible that you are in this very predicament now. All of us have read that everyone is pulling our credit reports to see our credit history. Your credit report can be quite violating, kind of like being in front of a crowd with no clothes on.

With your credit no longer being a secret and a intricate part of our lives, the question is does past credit mistakes really ever go away? The credit bureaus say that some past credit history goes away after 7 years. Some debts don’t to away until you pay them off, especially debts owed to the government. Let’s assume you have old collections on your credit report that fall into the 7 year rule with the bureaus. You pull your credit report and notice a collection that is well over 7 years old and you are still getting calls for this collection as well. What do you do? The first step is to dispute the collection with the credit bureaus that is still reporting the collection. When you dispute the collection, you dispute the fact that the collection has expired. Within 30 days the collection will be removed. So yes, after 7 years of collection calls and being told no, your collection will eventually go away. This is granted that the bureaus have removed that collection, but in some cases you will need to dispute that collection to get it removed.

I wrote an article a while back on collections and when they expire. Go to collection expirations article. I would recommend reading this article after you have pulled your credit report. If you find some collections on your report have expired, dispute them with our online resource.

Author: Mike Clover

CreditScoreQuick.com your resource for credit reports, credit cards, loans and credit news.

Posted in Uncategorized | Comments Off

Friday, February 19th, 2010

Did you think that your bad credit score might affect our economy or somebody else? If you thought this, your thoughts were correct. Let’s use some logic here. If your credit score is bad, this means you did not pay someone a debt owed which may have caused that company or person not to pay somebody else. I am sure people typically don’t think of this, but your bad credit and bad decision making caused a big part of what is currently going on in our present day economy. Did you think that your bad credit score might affect our economy or somebody else? If you thought this, your thoughts were correct. Let’s use some logic here. If your credit score is bad, this means you did not pay someone a debt owed which may have caused that company or person not to pay somebody else. I am sure people typically don’t think of this, but your bad credit and bad decision making caused a big part of what is currently going on in our present day economy.

When matters get bad it’s so typical of everyone to blame someone else. The fact of the mater is you are responsible for your own actions. Don’t blame it on the economy, or that you lost your job. Everyone is supposed to have 6 months savings in the bank for job loss or issues resulting in a down economy. Any financial advisor will tell you this. Like I have said in other articles we need better education of financial accountability in our schools and homes.

When people don’t pay there bills it affects everyone. Remember this, and don’t buy stuff you cannot afford or don’t need. I know we live in a materialistic world, but if you think about it, all this stuff really is not ours. We are just stewards of it. The bad decisions you make will ultimately affect other people. Before you embark on bad decision making, think again how that might affect others down the road.

I know the current media is making the banks out to be the bad guy, but ultimately we are responsible for what we do. Remember these companies that lend money are in business to make money, not to give you loans and credit cards for free. If you don’t want to get in debt which ultimately causes credit issues, don’t get stuff you cannot afford to pay back. I would recommend getting with a financial advisor today to get your finances in order before it’s too late.

Author: Mike Clover

Your resource for credit reports, credit cards, loans and ground breaking credit news.

Posted in Uncategorized | Comments Off

Friday, February 19th, 2010

Getting the best rate on your mortgage loan can mean a difference of thousands of dollars over the life of your loan, so it’s worth your time to show that lender that you’re a good risk and deserve the lowest rate. Getting the best rate on your mortgage loan can mean a difference of thousands of dollars over the life of your loan, so it’s worth your time to show that lender that you’re a good risk and deserve the lowest rate.

In general, there’s a 1 ½% difference between the highest and lowest interest rates offered. And on a loan of just $100,000 that 1 ½% means a difference of $26,888 over a 30 year loan.

The primary criteria in determining the rate you’ll pay is, of course, your credit score.

Since the mortgage crisis hit, lenders don’t even want to talk to you unless you have a score of 620 – and then you’ll qualify at the highest rate. In order to get the best rates, you’ll need a score of 740 or more.

So your first step when thinking of a home purchase should be to get a copy of your credit report, with scores, and read it carefully. Industry experts admit that over 70% of all credit reports contain errors – and those errors could lower your scores and cost you money.

Be on the lookout for anything that doesn’t belong on your report, or is incorrect. Check to see that your name is spelled correctly and that every previous address really is one of yours. Make sure your spouse’s name is listed correctly. And of course, check to see that every account listed really is yours. Verify that the account numbers are accurate, as well as the names of the creditors.

This is not just a good credit practice. By monitoring your credit report regularly, you’ll catch telltale signs of identity theft, and be able to nip it in the bud.

If you do find an error, file a dispute and get it corrected. This is an easy process to begin now that all three credit bureaus have online systems for error reporting. But it does take time, so don’t wait until you’re ready to apply for a loan.

Once you know your credit score, work to improve it and do nothing to lower it. Try not to apply for any new credit in the months or year prior to making application for a home loan. Pay down credit card balances and/or transfer balances so that no account shows more than 30% usage. Put off buying a new car until after your home loan is in place. And of course, be sure you pay every bill on time and never overdraw your checking account.

Another way to secure the best mortgage rate is to make a large down payment. The more you have invested in your purchase, the less risk you pose, so banks are willing to give you a better rate. Plus, if you’ve made a down payment of 20% or more, you’ll be exempt from paying for mortgage insurance – and that’s another large savings.

Author: Mike Clover

CreditScoreQuick.com your resource for credit reports, credit cards, loans and ground breaking credit news….

Posted in Uncategorized | Comments Off

Wednesday, February 17th, 2010

As of January 1, mortgage lenders have been required to use a new Good Faith Estimate (GFE) produced by the Department of Housing and Urban Development. As of January 1, mortgage lenders have been required to use a new Good Faith Estimate (GFE) produced by the Department of Housing and Urban Development.

According to government reports, and some consumer advocates who haven’t been subjected to use of the form, the new GFE (Good Faith Estimate) is just what home-buyers need – it simplifies and standardizes the fees that mortgage lenders charge and makes it easy to compare costs between lenders.

But once again, we see rules and forms being written by people who haven’t had the experience to know how those rules and forms will affect consumers.

It is true that all mortgage lenders have to use the same form now. But conscientious lenders are also using their own “old” forms in order to show consumers the truth of what they’re paying for. The new GFE lumps fees and costs together in a manner that prevents the buyer from knowing exactly what’s included.

It is also true that once the lender has entered his or her fees on the GFE and the buyer has agreed to them, they can’t change. So there are no last minute increases in fees. There’s even a limit on how much “estimated” fees such as appraisals and inspections can increase.

But there is where the benefit stops.

To begin with, because the lender is locked in to the interest rate and the fees, they won’t pre-approve a buyer and commit themselves to anything until that buyer has an accepted offer on a home. So buyers can’t go shopping with a pre-approval that would give them a better chance when negotiating for a home.

Second, many lenders will not provide the GFE until the buyer has paid for both a credit report and a loan application. That loan application could cost as much as $400. According to reports, Bank of America is now charging $300.

That means the buyer cannot “shop” for the best terms on a loan without making application with several lenders – and paying application fees with several lenders.

So before shopping for your home, call a few lenders and ask about their policies. Find out if you can make application without a fee. Then keep a list of those lenders who don’t charge an application fee – so you’ll be ready to shop for a loan just as soon as you have an accepted offer on a home.

It stands to reason that they need to check your credit scores before committing to an interest rate and fees, so you’ll need to pay for that everywhere you go. But I’ve never heard of anyone charging more than $60 for this, and many charge far less.

Author: Mike Clover

CreditScoreQuick.com your resource for credit reports, credit cards, loans and ground breaking credit news.

Posted in Uncategorized | Comments Off

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|

Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year.

Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year.

The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing.

The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing. While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.

While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.

Having bad credit can be a nightmare. Especially if you don’t have any money saved. You might find yourself in need of a loan, which will require use of your credit. I assure you that there will be a point in your life where your credit will be required of you. It is quite possible that you are in this very predicament now. All of us have read that everyone is pulling our

Having bad credit can be a nightmare. Especially if you don’t have any money saved. You might find yourself in need of a loan, which will require use of your credit. I assure you that there will be a point in your life where your credit will be required of you. It is quite possible that you are in this very predicament now. All of us have read that everyone is pulling our  Did you think that your bad

Did you think that your bad

Getting the best rate on your

Getting the best rate on your

As of January 1, mortgage lenders have been required to use a new Good Faith Estimate (GFE) produced by the Department of Housing and Urban Development.

As of January 1, mortgage lenders have been required to use a new Good Faith Estimate (GFE) produced by the Department of Housing and Urban Development.