|

|

|

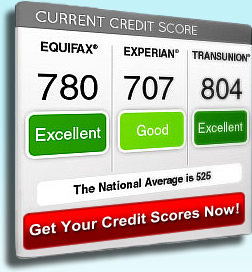

Free Credit Score ReportThe most determining factor for lenders in applying interest rates and terms for a loan is your credit score. Your credit score basically demonstrates to them your ability to responsibly pay your debts and handle your finances. Without a credit scoring system, lenders would have a difficult time determining the risk involved in granting loans. This would result in far more defaults and losses for lenders, which would greatly intensify their scrutiny in giving loans. In this way, credit scores actually make it easier for the average person to get the loans they need to invest in their future. CreditScoreQuick is dedicated to providing the tools you need to view and improve your credit score. In some ways, there is nothing more important than having a great credit score when building a financial foundation. Major purchases like homes and investments are made possible though loans with low interest rates and favorable terms, which are much more easily secured by those with great credit scores. Getting your free credit score report is easy at creditscorequick.com. Some websites offer a free credit report but don’t actually give you your score. Sure, you will receive information on your credit history, but you also need your actual credit score to know where you are and where you need to go. CreditScoreQuick provides a full free credit score report along with your score. Having this information at your disposal arms you with the negotiating skills you need when dealing with creditors and also helps you to strategize in rebuilding your credit. Once you have your free credit score report, you will need to spend time understanding your score and learning how to improve it. CreditScoreQuick offers a wealth of information and tools for accomplishing this. Here you can find articles from reputable sources as well as updated blogs on important credit topics. We also offer tools that monitor your credit report and notify you of changes. Score Watch lets you know when you qualify for better interest rates and it also determines what factors are most greatly impacting your current score. This takes away some of the guess work in determining what you need to do to improve your score. FICO Deluxe provides an even more complete picture of your credit situation from TransUnion, Experian, and Equifax. You will receive a complete score and report from all three of these major credit agencies. This service also provides a simulator that allows you to run hypothetical situations that might impact your credit. For example, “How will it affect my credit if I pay off this particular debt?” Another tool we offer at CreditScoreQuick is the secured credit card. For those with troubled credit pasts, it can be difficult to obtain a credit card. Not only are credit cards extremely convenient, paying credit cards responsibly is a great way to improve your credit score. By using some sort of collateral account, you can receive a secured credit card. Paying on this card responsibly will eventually increase your available credit and will also build your credit trustworthiness. Get your free credit report today and begin building the road to a great credit score and financial freedom. Your credit score is too important to ignore, because it helps to make it possible for you and your family to make the investments of a lifetime that can provide security for you and for those that come after you. Take the time to learn more about your credit score and utilize the tools we have to offer. You can start by getting your free credit score report now! |

|

Ever wonder what a FICO score stands for? Obviously, this is a credit score, but who determines what that score will be, and what does FICO mean? By taking learning more about the Fair Isaac Corporation, some of these questions can be answered...

Articlesbase.com Finance READ MORE.

What's my credit score?

What's my Credit Score, which is the million dollar question? Really, it's the million dollar question. The reason is your Credit Score could cost you millions of dollars over your life time. Your Credit Score could take two different directions, Good or Bad.

Let's assume it is bad, and you have 3 kids. Depending on your age, this situation could really affect a lot of decisions that you would have to make. Let's assume you need to borrow money, and because of your bad credit score, the interest rate is higher than the current market is allowing.

Finance and Credit Ezine Articles READ MORE.

Why Banks Don't Want You to Know Your Credit Score.

Let's face it, who makes the most money, an educated individual, or an un-educated individual? I am for certain we all know the answer to that. The banks do not want you to know your credit score, because that is your ticket to negotiating your interest rate and fees on loans you apply for. Since I am a lender, I know this first hand, but the difference is I disclose it...

Finance and Credit Ezine Articles READ MORE.

What Exactly Do you Get in a Free Credit Report?

In this article we will discuss the misconception of free credit reports. There are lots of advertisements out there saying get your free credit report. But what exactly does a free credit report come with? I have personally seen about 3 different types of credit reports being advertised out there....

Articlesbase.com Finance READ MORE.

No Credit Scores, can I get a Mortgage?

No Credit Scores, believe it or not it's very common. There are lots of people out there that don't have any credit. It is like a double edge sword, no credit could hurt you, but bad credit will definitely hurt you. Normally people that have no credit scores, fall into two categories. Young and just starting out...

Google Blogger Credit Score READ MORE.

How your Credit Score could cost you millions

As you may know, your Credit Score is a major determining factor in the approval process on just about every loan these days. When a mortgage company looks at your risk for determining whether they can lend you money, the rate is what could cost you over the term of the note. The interest rate is determined by your Credit Score in most cases. The difference between 6.0% and 7.0% on a $150,000 dollar home is as follows:

Sales Price: $150,000

Term: 30 Yrs

Interest rate: 6.0

Finance Charge: $196,254 is your interest over 30yrs minimum payment.

Sales Price: $150,000

Term: 30 yrs

Interest rate: 7.5

Finance Charge: $250,077 is your interest over 30 yrs minimum payment.

Wow, that is over $53,000 dollars more in interest charges for a higher interest rate. Typically a person with lower Credit Scores will get the higher interest rate ranging between a point to 2 points higher due to there risk. This is one example of how lower Credit Scores could cost you millions over your lift time. Just calculate all the different loans you have and at what interest rate you currently pay. You can begin to see how this could greatly affect your pocket book. The best way to prevent this unnecessary spending is to manage your Credit Report and Credit Scores. You can do this by obtaining a current copy of your Credit Report right now at www.creditscorequick.com.

Deter. Detect. Defend. Avoid ID Theft

L earn how to avoid identity theft � and learn what to do if their identity is stolen. Businesses can learn how to help their customers deal with identity theft, as well as how to prevent problems in the first place. Law enforcement can get resources and learn how to help victims of identity theft. Federal Trade Commission READ MORE.

Years ago, you could not even get access to your Credit Report. Finding out what was being reported about you was a BIG secret. As a matter of Fact, banks did not want you to know. The reason they did not want anyone to know, is because they cannot make money on an educated consumer. Now under the 2003 Fair and Accurate Credit Transactions Act, you are entitled to one Free Credit Report per year. But the big question is do I need a copy of my report? In this article I will discuss why you do, and what is going on in our market place that could affect you. Especially if you...

Google Blogger Credit Reports READ MORE.

Increase your Credit Score now!

Credit Scores and Credit Reports have been a mystery for most. Just about everyone that involves taking a risk in regards to you, wants to know your Credit Score. Since this is a fact in this day and age, you need to know your score. Lets assume you score is low, and you need to increase that score to get the Job, or a better interest rate on a mortgage. What do you do ? As a Mortgage professional I am going to educate you on what it takes based on results we have had over the years...

Google Blogger Credit Score READ MORE.

Fixing Credit Report Errors

After taking the first step of obtaining a free credit score report, the next most common step to improving your credit score is to correct any errors that might be present. Strangely enough, errors do occur, and it is well worth taking the time to dispel such inconsistencies. You must carefully scrutinize the report in order to correct things like account numbers, names, wrong information, as well as items that are out of date...

Google Blogger Credit Reports READ MORE.

Credit Score Mythology

There is so much information out there on improving your credit score that it is hard to know what really works. Because most people never take a class or fully understand the credit system, a host of myths and misinformation has developed regarding the subject. Some of these misnomers may seem logical or possible, but really have no grounds for proof. Sadly, much of this information is coming directly from sources that should know what they are talking about, such as bank representatives...

Articlesbase.com Finance READ MORE.

A Good Credit Score is Within Your Reach!

What does your credit score include? When you are establishing your credit, you may wonder what the credit agencies are actually looking for. Generally, they start out with your name, social security number, employers, current and past addresses, and your marital status. When someone gets your credit report, it includes things like when you make payments to your utility bills. Paying a bill late can stay on your credit history for years...

Google Blogger Credit Scores READ MORE.

creditscorequick.com was created by Mortgage professionals

We understand the need for consumer information in regards to your credit.

We found that most Americans had no idea what there credit score was based on mortgage loans originated with www.clovermortgagegroup.com. Over the years the lack of knowledge when it came to ones credit completely baffled our staff. We decided to come up with a company that will give the general public the tools to access your credit report with different features, and tools to better educate your self. Your credit is your life; if you don’t manage it properly it could cost you thousands of dollars over your life span. Just about everyone now wants to check your credit, insurance companies, new jobs, car lots, or any lending institution.

We produce educated consumers through this website.

We know a lot about credit since we work with it on a daily basis. We understand Credit Risk, and how the Bureaus calculate your Credit Scores. The difference between a 620 and a 650 could mean possibly not getting the job, a new car loan, or a mortgage. This difference could simply mean a recent late payment, high credit card debt, or I pay cash for everything, which is really bad way to live your life when it comes to credit. It is everyone’s responsibility to pay all debt on time, keep your credit card debt 30% under your credit limit. These are some key points we wanted to touch on in our introduction to this website. We will constantly be adding more useful tips on how to keep your credit scores high, and keep you informed as much as possible when it comes to your credit, which in reality is your life.

Any questions anytime, send to questions@creditscorequick.com

Seven Money Principles for Black Women

Suze Orman, best-selling author of the new book Women & Money: Owning the Power to Control Your Destiny, sits down with Essence to identify the financial rules every Black woman should know... Essence.com Read More.

|