Archive for the ‘free credit score reports’ Category

Tuesday, April 1st, 2008

If you have no credit scores due to being new to the credit arena or you have just been a cash person all your life there is hope for you. There is one sure way to get the credit score calculated in about 4 to 5 months. In this article I will talk about how to establish good credit scores for a healthy credit report.

Secured Credit Cards

A lot of people don’t know this but secured credit cards are the quickest way to establish credit. The reason for this is you give the bank money to secure credit that reports to all 3 credit bureaus. Typically you need about two cards to get the ball rolling. After 4 to 5 months of reporting “bam” you have credit scores. Typically creditors like to see 3 lines of credit reporting for a minimum of 12 months with good payment history. With this type of activity on your credit report, reporting to Experian, TransUnion and Equifax is one of the recipes for success. You will not achieve credit scores if you can not get someone to extend credit to you. That is the secret behind applying for a secured credit card to start the road to establishing this wonderful three digit life altering number.

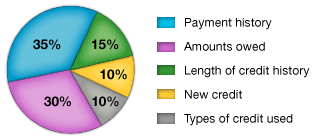

Here is an example of a mix of credit that Fair Isaacs scoring model uses to determine your risk which ultimately determines your scores.

Buy a house

Once you have about 12 months of rental history, with paying your utilities, and your secured credit cards on-time you will be able to buy a house. Of course you need to qualify for a loan with your current income. Getting a house is not as hard as one might think. If you have a two year work history and have 3 lines of credit like I mentioned earlier you can buy a home. Typically the type of loan you will qualify for is FHA. This is a great first time buyers program. Buying a house will help you get a mix of credit reporting on your credit report. This is around 10% of your overall score. When creditors extend credit to you they like to see that you own a home as opposed to renting.

Keep Credit Card Balances low.

Once you have got secured credit cards reporting on your credit report make sure you keep the balances below 30% of a your secure credit amount.

Example:

Secured Amount: $300.00

Balance at 30%: $90.00

This will keep your scores where they need to be once you establish them. After about 6 to 12 months you can request a limit increase. This is another sure way to increase your credit scores.

Get a car Loan.

Getting a car is actually easier than getting just about any other credit. There are all types of lenders out there willing to loan you money on a car loan. You might try getting a loan for a car to establish credit as well. Most car lenders report the note to all 3 credit bureaus. This is another way to get your scores rolling as well. Make sure it’s not some small tote the note establishment that does not report to the bureaus. Make sure the loan is reported to all 3 credit bureaus.

Conclusion: If you follow this advice you will be well in your way to establishing your credit scores. If you are unsure if you have scores get a copy of your free credit reporttoday.

CreditScoreQuick.com

Posted in free credit score reports | Comments Off

Saturday, March 29th, 2008

If you have collections on your credit report, you can count on most of them staying on there for minimum of 7 years from the original collection date. Sometimes you will have the collections sold to different collection companies. This could be a challenge trying to get the original collection date, but the creditor currently reporting the collection must report this information correctly. Typically the creditor reports the wrong original collection date, so you have to dispute it. They must comply with this request under the (FCRA) Fair Credit Reporting Act.

Here is how long items stay on your credit report from original collection date:

1. Medical collections – 7yrs

2. Charge Offs – 7yrs

3. Late payments – 7 yrs

4. Judgments – 7 yrs

5. Tax Liens – until you pay off

6. Repossessions – 7yrs

7. Chapter 7 Bankruptcies – 10 yrs

8. Chapter 13 Bankruptcies – 7yrs

9. Collections – 7 yrs

10. Inquiries – 2 yrs

11. Foreclosure – 7 yrs

I am sure you have heard you can get obligations that you owe removed from your credit report. I will tell you and so will the FTC that you cannot get obligations removed from your credit report even though you owe the debt. The only items you can get removed are items that are not correct, for instance.

- Maybe you and your father have the same name, and report is skewed

- Items over expiration date

- Inaccurate reporting, like slow pays.

Maybe you don’t know what is being reported on your credit report. Its time you find out, so if there is inaccurate information you will know. Current statistics show that 1 out of 4 credit reports have incorrect information on it that would cause a denial of some type of loan.

CreditScoreQuick.com

Posted in annualcreditreport, bad credit, free credit report, free credit score reports | Comments Off

Saturday, March 29th, 2008

This is a step by step guide that will give you the tools to fix inaccurate information on your credit report. First you need to check when the information being reported is set to expire. Next use our customizable dispute letter, and sent it to the Credit Bureaus. It is really that simple.

Step 1: Look for incorrect information being reported about you:

Order a current copy of your credit report with scores from all 3 Bureaus online. Print your credit report and view it carefully. Make note of any information that is not correct. Determine when the information is set to expire. This guide will help you determine if and when the negative information on your credit report will expire.

Public Records:

a.Bankrupcties- Chapter 7 Bankruptcy will expire from your report after 10 years of file date. Chapter 13 will expire from your report after 7 years from file date.

b. Judgements- Court ordered decisions stay on your credit report for 7 years from file date. Example: child support, civil and small claims court.

c.Tax Liens- Tax liens stay on your credit report until you pay it off. Once you have paid the tax lien, it will stay on there 7 years from paid date. This applies to City, State, and Federal tax liens.

Charge –off – records- this record will show up on your credit after a creditor has wrote off the debt as a loss. This will remain on your file for 7 years.

Inquiries- Records of application for credit. These types of inquires usually stay on credit for a maximum of 2 years. Checking your credit online with credit sores does not damage your credit like these inquires do.

Closed Accounts- This information whether negative or good stays on your credit report for 7 years.

Collection Accounts- This record should expire after 7 years from the last 180 day late payment that led the account to collection to begin with. The expiration date is the same even if the collection is sold multiple times.

Foreclosure Records- Foreclosure and property deed-in-lieu records remain on credit for 7 years from foreclosure date.

Late Payments- Late payments stay on record for 7 years.

Repossession Records-Vehicle repossessions stay on you credit report for 7 years.

Use this expiration information to determine what should not be on your report. You should also check for information that is being reported on there that is not yours. Also make sure there is no information that are cross records either.

Step 2: Write Dispute Letter

Once you have determined what is not correct on your report, it is time to write you disputes to the Bureaus. You will need to send the letter to each of the credit bureaus via certified mail.

Example dispute letter:

Date

Your NameMailing AddressCity, State, Zip

Re: Disputing Inaccuracies on My Credit Report

Name of Credit Reporting Bureau Mailing Address City, State, Zip

Dear Sir or Madam:

I am writing for two (2) reasons:

1. To dispute certain information in my credit file; and

2. To have you investigate/re-investigate and remove inaccurate information from my Credit Report and prevent its re-insertion. The item(s) I dispute are encircled on the attached copy of the credit report and further identified by (identify the items by name of source, such as creditor or tax court, etc. and identify type of item, such as credit account, judgment, etc.)This item is (inaccurate or incomplete) because (describe what is inaccurate or incomplete and why). I am requesting that the item be deleted (or whatever specific change you are requesting) to correct the information.(If you are enclosing documents such as copies of canceled checks, payment records, court documents, send copies only, you should always retain the originals — and use the following sentence.)

Enclosed are copies of the following documents supporting my position?

1.

2.

3.

Please reinvestigate this (these) matter(s) and (delete or correct) the disputed items within the time frame required by the Fair Credit Reporting Act (FCRA) and inform me in writing of the outcome. Thank you for your time and consideration in this matter.

Sincerely,________________________

(Signature)Your name

Step 3: File your dispute

Submitting your dispute by mail is the suggested way, but only Equifax and Transunion allows this kind of dispute. Experians requires all disputes to be submitted online.

Here is the 3 Credit Bureaus information.

Equifax

P.O Box 740256

Alanta, GA 30374-0241

Dispute online

Experian

Dispute online

TransUnion

2 Baldwin PlaceP.O. Box 2000

Chester, PA 19022

Dispute online

Step 4: Manage Results

The 3 Credit Bureaus have 30 days to investigate your dispute and update your credit report if the dispute is valid. Once they have investigated your concern, they will send you a letter stating what was updated on your credit report. If you were not able to get a inaccuracy fixed you will need to resubmit your dispute with new documentation.

CreditScoreQuick.com

Posted in credit bureaus, fix credit, free credit score reports | 4 Comments »

Friday, March 28th, 2008

A credit inquiry is an item on your credit report that shows with permission a creditor requested your free credit report.

Not all credit inquiries affect your credit score:

You may notice when you pull your credit report there are inquiries on there from a business you are not familiar with. The only inquiry that affects your credit score is the one where you are applying for credit. This is considered a hard pull on your report.

Inquiries that affect your credit score:

There is only one type of inquiry that affects your credit score. This type of inquiry is applications for a mortgage, auto loan and other credit, by you authorizing these creditors to access your credit report. This type of inquiry prompted by your own actions ends up on your personal credit report and affects your score.

An inquiry that does not affect your credit score:

Checking your own personal credit report or any business that offers goods and services that requests your report. A business that you already have a account with that requests a check. A potential employer that does credit checks. Some of these types of inquiries might show up on your report but do not affect your credit score.

Checking your credit report does not affect your Credit Score:

Checking your credit report on a regular basis to ensure it is accurate and error free is recommended by Fair Isaac the inventor of the FICO Score. Maintaining a error free credit report is part of credit management which will improve your credit rating over time. Ordering your credit report at CreditScoreQuick.com does not hurt your credit score.

How credit inquiries are factored in your Credit Score:

There are five types of information used to calculate your credit score. Each category accounts towards a percentage of your score.

Payment History – 35%

Amounts Owed – 30%

Length of Credit History – 15%

Types of Credit in use – 10%

New Credit – 10%

Don’t let inquires scare you. There is nothing wrong with shopping for a better rate, or better terms on a loan. As you can see in the about chart, payment history is the biggest factor in calculation process of your credit score. The second biggest factor is how much of your approved credit limits are charged up. But of course you don’t want to go out and start applying for every credit offer out there either. Be responsible and have a good mix of credit, but stay away from too much credit as well You really on need 3 lines of credit reporting on your credit report.

Example:

1. credit card

2. car note

3. installment loan

This type of credit mix accounts for 10% of your score.

CreditScoreQuick.com

Posted in credit report, free credit report, free credit score reports | 2 Comments »

Wednesday, March 26th, 2008

The Credit Score of Warren Buffet was recently reported to be a 718 by Fortune Magazine. You are probably wondering how in the world is this possible. He is supposed to be the richest man in the world. The Credit Score of Warren Buffet was recently reported to be a 718 by Fortune Magazine. You are probably wondering how in the world is this possible. He is supposed to be the richest man in the world.

When it comes to your credit scores it does not matter how rich you are, your credit score has nothing to do with how much money you have in the bank. No matter how much you have in assets, your credit score will always be determined by your credit history. The reason for Warren not having a credit score above a 720 could be for any number of reasons.

Example:

Late payments

High balances on credit cards

Inaccurate information being reported on credit report

We know that wealthy people can have applications for loans turned down just like anyone else. That is why your credit scores are very important. You never know when you might need a loan, don’t let your credit scores get you denied. This goes to tell you that your credit scores speak louder than dollars.

How to beat a millionaire.

Here are some tips to increase your score; you never know a bad credit score could cost you that job that pays millions.

1. Never, never be late on your bills. The quickest way to lower a credit score between 100 and 150 points is to have a 30 day late on credit report. Set up on-line bill pay, that way you don’t have to worry about whether you are on time or not with obligations to your creditors. Unless you are rich, you will probably need a loan one day, and you don’t want a creditor to so no because of your score.

2. Limit yourself on how much credit you have. Don’t apply for ever credit card offer that comes. Typically you don’t need more than a couple of low interest rate credit cards.

3. Don’t charge up your credit cards like you are a Warren Buffett. To go out and max out your cards will cause a disaster for your future FICO score.

Posted in free credit score reports | Comments Off

Monday, March 24th, 2008

What is the current Crisis What is the current Crisis

Over the last 10 years our country went through a real estate boom. There were three categories of loans being provided. The first was Prime, the second was Alt a, and the third was Sub-Prime loans. Typically any loan less than Prime had higher rates because of the risk of the borrower. The Sub prime loan was a creative loan that was provided and is currently the reason for around 46% of foreclosures in the U.S. This is astonishing if you think about it, and is the cause for a downturn in our economy. When you have this type of debt being wrote off, someone is affected. That is why our banking industry has had a liquidity problem. There were more loans being bought back than there was cash in the bank.

Insight on reason for foreclosures

Most of the mortgages given during this real estate boom that were Sub-Prime were adjustable rate mortgages (ARM). This type of loan looked very attractive with its initial “low teaser rates”, which typically expired after 2 years. Most of these loans were set to reset between 2 to 5 years which would cause the payment to increase dramatically. The selling point on these loans over the years was, if you keep your credit rating good you can refinance your ARM loan into a 30yr fixed mortgage once the ARM reset. Unfortunately with the declining property values and the tightening up on underwriting guideline it has made it impossible to refinance these types of loans. The result is the mortgage payment will increase dramatically and a foreclosure to follow afterward s. Since all of this has taken place we are seeing global implications on foreign investors that might have put there stock in Mortgage backed securities. IN other words investors global wide are pulling there interest out of these types of loans. Since the book is still being written on this crisis we anticipate the overall economy to feel the strain of this unfortunate crisis and for ARM loans to be less common in the future.

What can I do about my current ARM loan?

Here are the steps in regards to determining whether you can refinance your current loan.

* Determine if you have the current credit to refinance into a FHA loan.

* Determine if you have the equity to refinance your current mortgage

* Call your loan officer to determine if they can help you

If you feel you are not going to be able to afford your mortgage payment, call your lender before you are late on payments. Make arrangements with them rather than not notify them at all. If you find that your lender will not work with you there are counselors that you can talk to.

Here is a list:

Hope Now

An alliance between counselors (HUD approved), servicers and investors that strives to keep homeowners in their homes by helping them renegotiate their loans.http://www.hopenow.com/

Homeownership Preservation Foundation

A nonprofit that creates partnerships with local governments, nonprofit organizations, borrowers and lenders to help families overcome obstacles that could result in the loss of their homes. http://www.995hope.org/

Counseling Agencies Approved by HUD Developments

The U.S. Department of Housing and Urban Development (HUD) sponsors housing counseling agencies throughout the country that can provide advice on buying a home, renting, defaults, foreclosures, credit issues, and reverse mortgages. http://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm

NeighborWorks Center for Foreclosure Solutions

Works to preserve homeownership in the face of rising foreclosure rates. http://www.nw.org/

Financial Education/Assistance

My Money Management

A collaborative effort by the financial services industry to provide consumers with access to financial education to help inform their personal finance decision process.http://www.mymoneymanagement.net/

FHASecure plan

A refinancing option that gives credit-worthy homeowners, who were making timely mortgage payments before their loans reset but are now in default, a second chance with a FHA insured loan product. http://portal.hud.gov/

Here are some helpful tips for avoiding foreclosure from U.S. Housing and Urban Development.

CreditScoreQuick.com

Posted in ARM, FICO, foreclosure, free credit report, free credit score reports | Comments Off

Saturday, March 22nd, 2008

Did you think checking your credit report was not necessary? I would think again, recent studies show most employers are checking your credit as part of the decision process. They are looking into your personal history is to see if you are responsible enough to hold a job. Companies don’t want to hire someone that is financially tapped out; someone that is in this situation might be desperate and attempt to steal. Did you think checking your credit report was not necessary? I would think again, recent studies show most employers are checking your credit as part of the decision process. They are looking into your personal history is to see if you are responsible enough to hold a job. Companies don’t want to hire someone that is financially tapped out; someone that is in this situation might be desperate and attempt to steal.

Jobs that involve money handling

A position that involves an employee handling money will typically require a credit report check. These companies do a background check as well. If a company is hiring you to handle there money, they want to make sure you are very responsible. There are accounts where potential employee applied for a position with a company as was denied employment due to bad credit. If you think your credit report is littered with collections, charge offs and late payments you might want to work on cleaning those types of issues up. This type of activity whether it’s a professional job or a cashier job could cost you a potential opportunity.

Government Jobs

When the government looks into hiring an individual they pull your credit report. They want to make sure you are not a security risk. They also pull your credit after you have been hired. Judy Langley was hired at by the “City of Dallas” for a clerical position. The requirement was once she was hired she had to improve her credit. The city hiring manager knew she had some credit issues, and required that she improve her credit over a 12 month period. In other words if you have past credit issues, your new employer could require you to clean it up.

Your Rights under the Fair Credit Reporting Act (FCRA)

The FCRA requires written consent on your behalf before an employer can pull your personal credit score report and/ or background check. Nether less if you suspect you have credit issues, and you are in the market to find that dream job you might want to pull a recent copy of your report with scores. Everyone looks at your credit scores as well. When an employer uses your credit report as part of the hiring process, they are suppose to inform you of this. If they deny you employment due to your credit, they are supposed to do two things:

* The employer is supposed to give you a copy of your credit report and give you your rights under the FCRA.

*The employer is also to disclose which company gave the information so they can dispute any information that might be inaccurate.

Rather than go through all of this they will simply say you were denied for other reasons.

Find out what’s on your record

This is why it’s so important to pull your credit report regularly, so if you have to get a new job or your current employer is doing credit checks, you don’t want to have issues due to bad credit decisions.

CreditScoreQuick.com

Posted in credit report, fix credit, free credit score reports | Comments Off

Wednesday, March 19th, 2008

A credit score is a number that reflects your creditworthiness at any given time. Typically the higher your score the better your credit. Individuals with higher credit scores typically can obtain mortgages, credit cards, loans and insurance with better terms. The lower your score the worse your terms are on any offer. The Credit Score is based on the information stored with in your credit report.

Each Bureau has its own score

Each Bureau has its own name for the FICO® Score.

Equifax – Beacon

TransUnion – FICO Classic

Experian – FICO Risk Model

The general scoring ranges between 300 – 850. Fair Isaac divides the scores into five categories.

780 – 850 – Low Risk

740 – 780 – Medium – Low Risk

689 – 740 Medium Risk

620 – 690 – Medium High Risk

620 – and Below – High Risk or “sub-prime.”

A credit score can change quickly for several reasons, including late payment or big increases in credit card balances. Each credit bureau may not have identical information about you, in large part because some creditors only report to one or two bureaus instead of all 3. This results in different credit scores amongst the credit bureaus. Some insurers and creditors use there own formula to calculate score in conjunction with the FICO score model. For example one lender might emphasize more on payment history within the credit report, where another lender might focus on something totally different within your report. A credit score itself might be the determining factor of better rates and terms with other creditors. But in the insurance context, the “credit-based insurance score, “typically is on of the many factors determining whether a policy is underwritten or at what premium. Most lenders and insurance companies scan your credit report for derogatory terms like bankruptcy, judgments, foreclosures, and collections.

How is a credit score calculated?

Factor 1: Payment History (35%)

Factor 2: Amount Owed – Extent of Indebtedness (30%)

Factor 3: Length of Credit History – The Longer, The Better (15%)

Factor 4: How Much New Credit? (10%)

Factor 5: Type of Credit (10%)

CreditScoreQuick.com

Posted in FICO, credit report, free credit report, free credit score reports | Comments Off

Monday, March 17th, 2008

Foreclosure is a common subject these days, but there is life after having one. If you have recently had a foreclosure on your credit report, you will be able to recover from this bad experience. Fair Isaac with its new FICO 08 with due time will forgive you for a foreclosure as long as you are not a repeat offender. This new calculated risk software understands that unfortunate situations come up in ones life, but don’t make the same mistake again. Definitely don’t make it a habit of having credit problems is the point. Foreclosure is a common subject these days, but there is life after having one. If you have recently had a foreclosure on your credit report, you will be able to recover from this bad experience. Fair Isaac with its new FICO 08 with due time will forgive you for a foreclosure as long as you are not a repeat offender. This new calculated risk software understands that unfortunate situations come up in ones life, but don’t make the same mistake again. Definitely don’t make it a habit of having credit problems is the point.

How long will it take before you can buy again?

Your credit report might recover quickly as long as you have other good standing credit reporting on your credit report. But that does not mean you can buy a home right a way. Most people that have foreclosures usually take time to recover from such a bad experience. HUD knows this, and that is why you cannot get a FHA loan for a minimum of three years from foreclosure date. It’s almost impossible to get a Conventional loan, because conventional loans are automated approvals. Typically with a foreclosure, collections or low scores this automated software will deny you. FHA is a different type loan all together, since it’s a government insured loan you can get what they call a manual underwrite for this type of loan. What this means is if the automated process through Freddie Mac or Fannie Mae says no, you can get an underwriter to manually approve the loan. So you can expect to wait at least a minimum of 3 years after foreclosure date before you can begin to think about financing a home again.

Pay everything on-time

When a bank lends you money, it’s a big risk. Banks don’t want to lend money to someone that has total disregard for their credit. If you have had a recent foreclosure the last thing you want to do is have late payments, collections or any other negative information hit your credit report. Let’s face it, the whole reason banks, mortgage companies, car dealers, landlords, and employers pull your credit report is to see if you pay your debts. I personally would not lend to someone that did not pay their bills back, would you? With the recent tightening up in the lending arena you might want really work on increasing your credit score. Also make sure you have at least 3 lines of credit reporting on your report. If you had to let everything go, you might consider getting a secured credit card. This type of card will help you re-establish your credit.

Save Money

Saving money is very important when it comes to getting a loan. Lenders like to see you saving money because it shows stability. Let’s assume you loose your job, well if you have 6 months payments in the bank you are less likely to let your house go. If a emergency comes up you have some money in the bank to assist in some way. Saving money also shows you are responsible as well. Let’s say two people go to the bank to get a loan and they both have bad credit. The main difference between the two bad credit borrowers is one has $5000.00 in the bank. Who do you think the bank is more likely to approve? These are some key point I wanted to touch on to revive your credit after a foreclosure. There is life after so make sure you manage your credit report and credit scores so you can begin home ownership soon.

CreditScoreQuick.com

Posted in credit report, fix credit, foreclosure, free credit report, free credit score reports | 2 Comments »

Wednesday, March 12th, 2008

Your credit score in 2008 is very important when it comes to buying a house. Heck your credit score is important when it comes to getting a loan period these days. Since the sub-prime mortgage meltdown, Wall Street has tightened up on what kinds of mortgage paper they will buy. Most loans are run through automated underwriting engines. The underwriting engine will either say yes or no, but here is the funny thing. Even though the engine says yes, the investor may have its own internal guidelines that would overrule an automated approval. This is not normal in the loan business. During the past years when you got an automated approval with either Freddie Mac or Fannie Mae underwriting engines you were golden.

Mortgage Insurance Companies

Since all the tightening up in the lending industry, the companies that insure these loans have tightened up as well. The reason for this is all the claims that are being filed as a result of defaults on mortgage loans. I have discussed in other articles how everything basically is based on risk, well so is insurance. If the insurance company sees a pattern with certain credit scores and loan types they will tighten up on the underwriting guidelines for those specific borrowers. Currently you cannot get a 100% Conventional prime loan unless you have a 680 credit score. Previously it was below 600 credit scores, but you had a higher interest rate. Currently they will just deny you of the loan, because they cannot get the loan insured. This mortgage crisis will affect everyone, including people with good credit. They will be able to get loans, but the loan guidelines will be more stringent.

FHA loans

FHA loans have been around since 1935. This government entity is the single largest insurer of loans in the world. FHA has baled the housing industry out of the tar pit right after the great depression. It looks like the same savior will be at it again in 2008. FHA loans have not tightened up, but again the investors that buy this paper have. Its common for banks to sell there loans to other banks. This is just a common practice these days. The only problem is the big banks buying paper from the small banks have really tightened up on what type of loans they will buy. With this being said, the entire process is getting tough all around.

Credit Scores

Your credit scores will either make you or break you when it comes to getting credit extended to you. With the disaster in the housing market, you can count on it getting even tougher with credit score requirements. So if you are in the market to get a home, I would recommend getting a copy of your free credit score report and see where your scores stand. Your score will be extremely important in this current lending market.

Posted in credit report, credit worthy, free credit score reports | Comments Off

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|