Archive for the ‘free credit score reports’ Category

Wednesday, March 5th, 2008

The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected. The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected.

Late payments

During the home buying process make absolute sure you are not late on anything. If you have a late payment on anything that reports to your credit report your credit score will be affected. In return an underwriter will see this and your loan could be dead as a result. Late payments on any obligations that reports to your credit report will drop your score between 100 to 150 points. “Don’t be late on anything.”

Don’t buy anything on Credit

While you are going through the home buying process you don’t want to take on anymore debt, this could affect your loan. That means don’t go out and put furniture on credit for your new home until you have closed and funded on the loan. Don’t put anything on credit period.

Don’t co-sign on a loan for anyone

While you are in the process of getting a loan, don’t co-sign on any note. This could cause your loan to get denied. When you co-sign on a loan, then you are equally responsible for the new obligation. This could lower your credit score, and also cause income to debt ratio problems as well.

Don’t quit your JOB

Ok, you might think this is a joke, but we have actually had borrowers quit their job thinking we would not find out. Well, guess what we will. Don’t quit your job during the home buying process; underwriters do last minute job verifications before loan documents go out to the title company for a closing.

I hope this has been advice you got prior to doing any of the above. You could definitely have some major problems. Maybe you have not even started the loan process, and this will be good advice for you. What ever your situation is, make sure you are on top of your credit report and scores. Your credit scores could be affected by any of the topics discussed in the article.

CreditScoreQuick.com

Posted in FICO, free credit score reports | Comments Off

Tuesday, March 4th, 2008

Buying a home is the single biggest purchase you will ever make. Surely you want to make sure it s a smooth process. We are a society that likes to touch and feel. Kind of like trying to buy a car, you want to take it for a test spin before you buy. Unfortunately that is not the way it works in the real estate arena. You will find that most “seasoned real estate” professionals will not jump in their car to show you a home until you have secured financing with at reputable lender. With the current credit crunch and liquidity problems with banks, you better make darn sure you can secure financing. Even individuals with good credit are having issues getting financing secured. Here are the steps to follow: Buying a home is the single biggest purchase you will ever make. Surely you want to make sure it s a smooth process. We are a society that likes to touch and feel. Kind of like trying to buy a car, you want to take it for a test spin before you buy. Unfortunately that is not the way it works in the real estate arena. You will find that most “seasoned real estate” professionals will not jump in their car to show you a home until you have secured financing with at reputable lender. With the current credit crunch and liquidity problems with banks, you better make darn sure you can secure financing. Even individuals with good credit are having issues getting financing secured. Here are the steps to follow:

Get Pre-Approved not Pre-qualified.

Getting pre-approved means you have a lender verify all documents to support the loan approval. Most lenders will run you loan through a automated engine. Once everything is verified and ran through either Fannie Mae or Freddie Mac engine you should be approved at that time.Pre-qualfied means that someone has taken your information over the phone and has not verified anything other than your credit report. This type of approval does not mean jack hill of beans.

Meet with your lender whom has approved you.

This is an important part of the process, so there is no misunderstanding on loan terms. Make sure you understand your payment interest rate etc………..

Find a reputable and seasoned Realtor.

Finding a seasoned reputable Realtor is so important; the reason is they need to understand the current market, and what to look out for on your behalf. A Realtor job is to look out for your best interest. Once you have been pre-approved, then the Realtor will have a better understand as too what type of negotiation process to start on a home.

This process is the best way to assure your home buying process is as smooth as possible. I am sure you hear of the nightmares out there, typically this is because the proper process in not followed. The end result is not good one. Lenders are looking at your credit scores very close now. Make sure before you start the process you pull a current copy of your credit report. That way you already have a idea where you stand.

Author: Mike Clover

Posted in FICO, free credit score reports | Comments Off

Friday, February 29th, 2008

I am sure we have all heard that you can get your credit report repaired if you hire a credit restoration company. They can repair it usually as long as you pay them around $1000.00 bucks to do so. According to the FTC, a credit repair company is not supposed to collect money from you until services are rendered. Hmmmmmmm. Good luck finding someone that will do that. Ok, here are the SCAMS.

1. I will increase your Credit Score 150 points in 30 days.

2. I will remove late payments on your credit report, even though you were actually late.

3. Don’t pay collections it hurts your credit

4. We can remove collections even though you owe the debt

5. We can remove Bankruptcies even though it’s still within 7 years.

6. We can remove a foreclosure, even though it’s still within 7 years.

7. We can remove judgments, even though you owe it.

8. We can remove tax liens even though you owe it.

9. If the balanced reporting is incorrect we can get collection removed

10. If the Bureaus do not respond to a dispute within 30days, they have to remove item in question.

I am sorry folks, but if you have debt you owe, it will be on there for 7 years from original collection date. No one can delete a debt you owe. I promise. Here is a good link for FTC facts on credit report repair SCAMS. Don’t get me wrong, there are credit restoration companies out there that provide disputes for inaccurate information, and are not SCAMS. Typically credit repair companies prey on the desperate, and take advantage of them. So be careful. I would also recommend pulling a current copy of your credit report, and make sure everything on there is accurate. You can actually do everything credit repair companies do for a fee for free yourself. You can go here for quick guide on how to dispute your credit report.

Author: Mike Clover

Posted in bad credit, credit bureaus, credit repair agency, credit repair company, free credit score reports | Comments Off

Wednesday, February 27th, 2008

Could your credit report be a racist report? We all know racism is a problem in the U.S., but of course no one wants to admit it. Is it possible that when calculating your credit score your result was lower because of the color of your skin, or because of your sex? Do the Credit Bureaus even know what race you are, or your sex? These are some interesting questions that need to be answered in this article. The following does not determine your credit score according to MyFICO. MyFICO is the inventor of the FICO score that 90% of banks use to determine your creditworthiness.

The following does not determine your credit:

- Race, Color, Religion, national origin, sex and martial status

- your age

- Your salary, occupation, title, employer, date employed or employment history

- Where you live

- Interest rates currently being charged on any account

- Any items reported as child/family support obligations or rental agreements.

- Whether or not you are participating in a credit counseling of any kind.

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Certain types of inquiries (requests for your credit report).

US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act. It is good to know that your credit report is calculated on other factors.

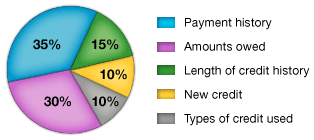

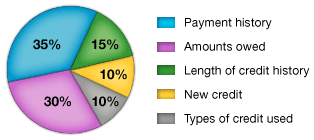

Below is a good example of how your credit score is calculated.

Now you can see how credit reports are not predjustice, they calculate your credit based on the information provided in the pie chart above.

Don’t forget to learn what creditors already know. If you are in the market to make a purchase you might consider getting your free credit score report. That way you know what they will find out.

CreditScoreQuick.com

Posted in FICO, free credit report, free credit score reports | Comments Off

Monday, February 25th, 2008

Credit Bureaus address and phone numbers are listed here. We have also listed the online dispute links as well. Your one stop resource for all 3 Bureaus.

Bureaus Addresses and Phone numbers:

Equifax

P.O. Box 740256

Alanta, GA 30374

(800) 797-7033

Experian

NCAC

P.O. Box 9595

Allen, TX 75013

(800) 583-4080

Trans Union

P.O. Box 2000

Chester, PA 19022-2000

(800) 916-8800

On-line dispute for each bureau:

Equifax

Dispute online

Experian

Dispute online

TransUnion

Dispute online

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, Internet identity theft software, secure credit cards, and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in credit bureaus, free credit score reports | Comments Off

Saturday, February 9th, 2008

The FTC claims that credit report Repair may be better for you if you do it yourself. You have seen advertisements on TV, local newspapers, internet. All of these credit report repair companies claim the following:

• “Credit Problem? No Problem!”

• “ We can get rid of bad credit problems – 100% guaranteed”

• “We can remove bankruptcies, judgments, bad loans and tax liens from your credit file forever

The FTC says “Don’t believe these statements. The only thing that will fix your credit is time, conscious effort, and a personal debt repayment plan will improve your credit report.

This article will explain how you can improve your creditworthiness and gives legitimate resources for low or no cost help.

The Scam

All over the US companies appeal to families and individuals that have bad credit problems. They promise for a fee, to clean up your credit report so you can get a car loan, a home mortgage, a job or even a insurance. The fact is, they cannot deliver. After you pay them hundred of dollars or even thousands of dollars in fees, these companies do absolutely nothing to improve your credit report. They typically vanish with your money says the FTC.

Warning Signs

If you feel credit repair with one of these companies is your choice, look out for the following.

• Companies that want you to pay before services are rendered

• Companies that don’t tell you your legal rights and what you cannot do yourself for free

• Companies that recommend that you don’t contact the credit reporting companies

• Companies that recommend you create a new identity by way of Identification Number.

• Companies that advise you to dispute all information in your credit report

Under the Credit Repair Organizations Act, credit repair companies cannot require you to pay until they have completed services they claim they can provide. The FTC says to get what they claim they can do in written, and once it is done then pay them.

The FACTS

No one can legally remove accurate information from you credit report. If you owe the debt, it will be on there for 7 years from original collection date. The law allows you the consumer to dispute inaccurate information on your report for FREE. There is no cost to you for doing this. Everything a credit repair company does for a fee, you can do it yourself for FREE. This is all in accordance to the Fair Credit Reporting Act (FCRA)

You are entitled to free credit report if you are denied for the following

1. Credit Application

2. Insurance

3. Employment

You are to ask for this report within 60 days of receiving this notification. You are also entitled to the free report if you are unemployed and are about to apply for job, if you are on welfare, or if your report is inaccurate because of fraud including identity theft.

All 3 Credit Bureaus – Equifax, Trans Union and Experian are required to provide you once a year with a Free Credit Report. In order to get this report you must go to annualcreditreport.com.

You are allowed to dispute items that are not yours for free. Under the FCRA any company that is reporting information about you that is inaccurate, this information must be updated correctly. If you owe the debt it will not be removed.

Step One

The consumer credit reporting company that is reporting information incorrectly about you must be informed in writing what information is inaccurate. You are to include a copy of documents backing your claim. You are to clearly identify in the claim the following

1. Your full name

2. Address

3. The item in the report that you are disputing

4. The request that it should be removed or corrected

5. Enclose a copy of the report and circle the item in question.

Your credit report dispute letter may look something like this:

Date

You’re Name

Mailing Address

City, State, Zip

Re: Disputing Inaccuracies on My Credit Report

Name of Credit Reporting Bureau

Mailing Address

City, State, Zip

Dear Sir or Madam:

I am writing for two (2) reasons:

1. To dispute certain information in my credit file; and

2. To have you investigate/re-investigate and remove inaccurate information from

my Credit Report and prevent its re-insertion. The item(s) I dispute are encircled

on the attached copy of the credit report and further identified by (identify the

items by name of source, such as creditor or tax court, etc. and identify type of

item, such as credit account, judgment, etc.)This item is (inaccurate or

incomplete) because (describe what is inaccurate or incomplete and why). I am

requesting that the item be deleted (or whatever specific change you are

requesting) to correct the information.(If you are enclosing documents such as

copies of cancelled checks, payment records, court documents, send copies

only, you should always retain the originals — and use the following sentence.)

Enclosed are copies of the following documents supporting my position:

1.

2.

3.

Please reinvestigate this (these) matter(s) and (delete or correct) the disputed

items within the time frame required by the Fair Credit Reporting Act (FCRA) and

inform me in writing of the outcome. Thank you for your time and consideration in

this matter.

Sincerely,

________________________

(Signature)

Your name

Once the investigation is complete, whether they removed the item or not, the creditor must give you something in writing. If the information was deemed incorrect, then they must remove it, and not put it back on your report.

Step Two

Advise the creditor or other information provider, in writing, that you dispute an item. Be sure to include copies only, not your original supporting your claim. The creditors usually provide an address for disputes. If the creditor reports the items to the 3 credit bureaus, they must include the dispute during the reporting time. If you are correct, the creditor must remove the item from the Bureaus it’s reporting too.

For information on “How to Dispute Credit Report Errors, go to ftc.gov/credit.

The reporting of correct information

When negative information is being reported about you, and it’s accurate the only way it will go away is with time. A consumer credit reporting company can report negative information about you for 7 years and bankruptcies for 10 years. Judgments can be reported for 7 years or until the statue of limitations run out.

Credit Repair Organization Act

By law credit repair companies must give you a copy of the “Consumer Credit File Rights Under State and Federal Law” before you sign any contract. They must also give you a written contract that specifies your rights and obligations. Read these documents carefully before you sign anything.

Example of what a credit report company cannot do:

• Charge you for anything until services have been completed

• Make false claims about there services

• Provide any services until they have your signature on a written contract and have completed a 3 day waiting period.

During this time you may cancel the contract without any fees occurred.

• Payment terms for services rendered, along with total cost

• Detailed description of services you are paying for

• How long it will take to achieve results

• Any guarantees they offer

• Company address and name

Check your Credit Report at least 4 to 5 times a year.

Even if you don’t have poor credit, you need to know what’s on your credit report. Here are some good reasons per the FTC.

• Because the information it contains may affect whether you get a loan and the payment terms for that loan

• Make sure the information is accurate, complete, and up to date before you apply for a mortgage, credit card, car, insurance or even a job.

• To help guard against identity theft

Hopefully this has shed some light on credit repair, and the importance of have a recent copy of your free credit report.

Source: http://www.ftc.gov/bcp/edu/pubs/consumer/credit/cre13.shtm

CreditScoreQuick.com

Posted in bad credit, credit education, free credit report, free credit score reports | 4 Comments »

Thursday, January 31st, 2008

Your credit score could be affected by little mistakes made on your part. These mistakes are made all the time, and most don’t realize the impact on your credit report and credit score. We have seen these common problems quite often, even though you are providing help for a family member or friend.

Co-signing for loans:

One of the most common credit mistake is co-signing on a loan for friends and family members that don’t pay there bills. Yes you thought you were helping someone out, but in return hurt your personal credit. Over the years we have seen more and more people helping out other people with loans, and there credit report is littered with late payments. The result is sorry we cannot help you with the loan you are applying for because your credit score is too low. Late payments will drop your credit score 100 points. So if you had a 700 FICO score, now you have a 600 FICO score. So don’t co-sign for someone else. They need to learn how to establish credit on there own.

Closing Credit Card Accounts:

Fair Isaac Corporation does not recommend closing out credit cards, especially if the card is in good standing. Once you close out a card that is a good revolving line of credit, you just dropped your scores. This credit was reporting in good standing with a credit limit, the credit limit is a part of your credit score. So if you close it, you score will drop due to good credit being removed.

No Credit Cards will hurt your Score:

If you thought it was ok to avoid having credit cards you are wrong. Fair Isaac recommends having credit cards, but use them responsibly.

High Credit Card Balances:

High credit card balances will lower your credit score as well. According to Fair Isaac your balance should not be more than 30% of credit limit. The lower your balance is the higher your credit score will be. This is the quickest way to increase your credit scores.

Don’t give up:

Maybe you have made some mistakes, and now you are on the road to recovery. Remember your credit is just a snapshot of your credit during a particular time. You can always improve your credit by paying down your balances, and being on-time with your payments to creditors.

CreditScoreQuick.com

Posted in bad credit, credit education, credit repair company, credit report, free credit score reports | 1 Comment »

Thursday, January 31st, 2008

Current studies show that ID theft is at epidemic proportions. The Federal Trade Commission surveys estimated that there are close to 9.9 million victims and growing by 2 to 3 million a year.

For individuals that are not victims of identity theft, the best thing you can do is check your credit report regularly, focusing on two categories.

• Inquiries from unfamiliar companies. Here we are talking about someone applying for something in your name in a state that you don’t live in. Remember inquiries are the result of you applying for credit.

• Unfamiliar Accounts (tradelines). Are there debts or new credit listed on your credit report that you are not familiar with?

There are 3 major credit bureaus that provide services to monitor your credit report. These services give e-mails to you promptly if there are any changes to your report.

What to Do if ID Theft happens to you.

You want to keep a detailed log of events as you start the dispute process. You do this in case you run into problems with a creditor. The first step obviously is contact the 3 credit bureaus, local police, creditors, etc…… You keep detailed conversations logs with any of these entities you communicate with. Also keeps receipts, bills, or out of pocket expenses you incur during the process of disputing. I would also make note of the emotional stress and how it is affecting your work performance and personal relationships. In addition your expenses and time could be tax-deductible in certain circumstance.

Contact Law enforcement

Here is the properties procedure for contacting the authorities so you can file a formal report. You should include all fraudulent accounts in the report. As the Credit Bureaus say they are able to remove disputes, remember to keep a copy of the report number and contact info.

Who to contact:

• FTC.gov/bcp/coline/pubs/credit/affidavit.pdf

• Local Police Department

• FTC 800-438-4338 or 800—ID THEFT

Credit Bureaus – Steps to take with the CRAs

• Notify one of the credit bureaus fraud units that you are victim of Identity Theft. This Bureau will be responsible for telling the other 2 Bureaus. (Equifax: 800-525-6285; Experian: 888-397-3742; Trans Union: 800-680-7289)

• Tell Bureaus to flag you credit report with fraud alert

• Get a copy of your credit report with scores

• Once you have read your report, send a dispute letter, accompanied with police report along with the FTC fraud affidavit specifying which accounts are fraudulent.

• Subscribe to the Bureaus monitoring services of your credit report

• Consider signing up for Identity Guard.

• Ask the Bureaus to contact the creditors that fraudulent activities have taken place.

Debt Collectors- You will be getting calls from debt collectors more than likely. If they call you:

• Get the debt collectors companies name, address and there phone number. Let him or her know you are noting the time and date of the conversation in your log activity book

• Inform the collection agency you are a victim of Identity Theft

• Provide the FTC uniform fraud affidavit

• Ask for number and name of credit issuer.

• Send the debt collector a letter, stating that you do not owe this debt and that the account has been close.

• Request in writing that the account is being flagged as fraudulent, and is being closed. You also should request in writing that the fraudulent account is being removed from your credit report.

New accounts opened in your name: the Identity Thief has opened new accounts in your good name: what to do. The credit report you pulled should list all creditors that have accounts in your name with contact numbers.

• Notify each creditor of the identity theft that has taken place to you. You will be asked to send a fraud affidavit. (Be sure to put all of this in your log)

• Ask the creditors to send you any application or fraudulent activity that has happened in your good name.

• Add passwords to all accounts

• If the thief has got a hold of your checking account, credit cards, get replacements with new numbers. Call and request these accounts to be closed as well.

• Fill out FTC uniform fraud affidavit.

Your Checking account- If the thief has wrote checks in your name here is what you do.

• Call your local police, and file a report

• Call your bank and close the account immediately

• Remember to keep good logs

• Typically your bank will refund you your money, and ask for a copy of police report filed.

This stuff is serious business; I hope this will help you resolve issues involving identity theft to you.

CreditScoreQuick.com

Posted in credit report, free credit score reports | Comments Off

Monday, January 28th, 2008

Have you thought about getting a copy of your Credit Report? Years ago there were complaints that credit reports were hard to read for the consumer. In past years Equifax, Experian and Trans Union had changed the format of the reports to make them more readable and understandable. Each of the 3 Credit Reporting Agencies or ( CRAs) have ways of referencing a credit report with them.

For Instance:

Equifax – Confirmation number

Experian – Report Number

Trans Union – File Number

These particular reference numbers will be asked if you are disputing any of these credit bureaus.

To make matters more difficult, “Credit Report” is not the official term. The Fair Credit Reporting Act calls the credit report for consumers “Consumer Report.” The industry refers to the report that creditors sell as “credit report.” Nether less either one has the same purpose. They give an account of your personal credit history with creditors.

Here is an example of what you need to identity you with all 3 Bureaus.

First Name:_______ Middle Name:________ Last Name:_______

Birth date:_______ Social Security Number:________

Current Address: Typically two year residence history

Current Employer: ________

Here is what to expect to see on your credit report.

1. Your identifying information listed above:

2. Your Payment history, including auto payments, credit card payments, installment loans, and mortgage history.

3. Public Records: bankruptcies, tax or other liens, and judgments.

4. Inquires showing which companies accessed your credit report for different purposes.

Identity Information

This information is very important, and needs to be accurate. The CRAs use your personal information to determine which report to route your information. If you input the wrong information when getting your credit report, it can lead a report that results in mixed files, and other inaccuracies. This definitely pertains to inputting the correct social security numbers. Maybe you are a JR, and your information is getting mixed with your father or son. Believe it or not this is a common problem with credit reports. You may have to dispute this information with the CRA that is reporting incorrectly.

Credit History

A bankruptcy can remain on your credit report for 10 years; other negative information typically is on there for 7 years unless you can get the creditor to give you a letter to delete a negative item from the CRAs. A tax lien that is not paid can stay on your report for ever. Once you pay it, from the paid date it stays on your report for 7 years. Here are terms and there meaning as they are listed on your report.

Public Records: Bankruptcies, court and default judgments, liens, and foreclosures

Late Payments: Typically falls into one of the four categories, 30 day late, 60 day late, 90 day late, and 120 day late.

Charge Offs: Accounts that are in default of original contract and terms. Charge off is a book keeping term which means the creditor reports obligations as a loss.

Collections: A account that is so delinquent that the obligation is turned over to a collection company for collection.

Typically after all the bad is listed, the report will list all the accounts in good standing. Experian and Trans Union reports “never late”, and Equifax reports as “pays as agreed.”

You will want to always make sure all information is accurate.

Inquiries

Any time someone checks your credit for loan, credit card, installment loan or a mortgage you will have on of two types of inquiries: “hard” and “soft.” Soft inquiries don’t drop your credit score, but too many hard inquiries you could drop your score.

Account History Status Codes

Equifax report will list codes showing how you are classified when you do not pay your bills on time. Also a credit report will show types of credit, “I” for installment loan, “R” for revolving and “M” for mortgage. Here are numeric codes as well.

1: On Time

2: 30-59 Days Past Due

3: 60-89 Days Past Due

4: 90-119 Days Past Due

5: Over 120 Days Past Due

7: Included in Wage Earner Plan

8: Repossession

9: Charge Off

Blank: No Data Available for that month

0: Unrated

Description of Accounts

Date Account Closed

Date Account Opened

Company Name – The Creditor

Account Number

High Credit

Credit Limit

Terms of payments 360 months or 30 yrs

Number of months reviewed

Date Reported

Balance

Past Due Date

Activity

Date of Last Activity

Charge Off Amount

Deferred Payment Date

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, Internet identity theft software, secure credit cards, and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in FICO, credit report, credit worthy, establish credit, free credit score reports | Comments Off

Thursday, January 24th, 2008

Now that the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 is passed, it is a lot harder to wipe away your debt. At one time just about anyone could file Chapter 7 and wipe the slate clean. This new bill has a lot of debate. Some say it is prejudice against the consumer. Regardless of the merit of this passed bill in 2005, it makes it tougher these days to file Chapter 7 Bankruptcy. One of the major changes is if your income is greater than the state median income, your motion to file Chapter 7 will be dismissed and you will have to file Chapter 13 repayment plan for 5 years. With this new bill more people are being forced to file Chapter 13, as opposed to Chapter 7.

Differences between the two Bankruptcies:

Chapter 7 Bankruptcy- A chapter 7 bankruptcy basically dissolves all debts that legally qualify for this process. Typically most debts get discharged in this type of bankruptcy. Discharged in Bankruptcy terms mean all liabilities get erased. So in other words you are no longer legally required to pay back a unpaid debt included in the bankruptcy. On your credit report from file date for 10 yrs.

Chapter 13 – A chapter 13 is different than a Chapter 7 because the consumer must pay off debts over time. You pay these debts to a court appointed Trustee. This option is usually for individuals that have steady income. On your credit report from file date for 7 yrs.

Since Chapter 7 is no longer the easiest option for filing bankruptcy, you might consider letting your debts go to collection if you are in a pinch. You always can go back to the collection companies and negotiate a lesser balance agreement. The original creditor pretty much already wrote off the debt anyways. So these collections companies just bought the debt, and will settle for pennies on the dollar. This is just an option. It is better to let an obligation go to collection and settle on the debt once you are on your feet versus filing Chapter 7 or 13. We also know that there are situations where you need to file Bankruptcy.

So we believe that there will be less people filing Chapter 7 since it’s not available to everyone now. I am sure you can see how each bankruptcy could affect your credit differently. This new reform bill will force more people to be a little more responsible, and less likely to jump on the bankruptcy bandwagon. More people will also be forced to file Chapter 13 and pay back a portion of the debts. This option is less harsh on credit than Chapter 7. Regardless filing bankruptcy period will destroy your credit score and credit report for quite a while.

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, Internet identity theft software, secure credit cards, and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in bad credit, free credit score reports | Comments Off

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|

The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected.

The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected.