Archive for the ‘FICO’ Category

Friday, April 24th, 2009

No. In spite of rumors to the contrary, FICO has not changed its scoring system to bring credit scores down.

Credit scores are falling because of actions on the part of credit card issuers.

These lenders, in an effort to make more money while reducing risk, are lowering credit limits and raising interest rates. And it isn’t just the “risky” borrowers who are being singled out for this action.

In fact, prime targets are consumers who keep low balances, use their cards sparingly, and have few if any late payments.

For the banks, unused and under-used cards limit profitability, so they’re lowering credit limits to reflect the actual use of those cards. In some cases, they’re even lowering them to less than the balance owed – putting unsuspecting card holders over-limit and triggering penalty fees.

A recent survey by the Federal Reserve Board revealed that about 45% of all domestic card issuers are taking this step.

Unfortunately, this action on the part of just one card issuer will lower a consumer’s credit score – which can in turn trigger the same action on the part of other card issuers. As you can see, this is a trend that can snowball, causing a responsible card holder to see his or her credit scores falling like a rock.

The FICO scoring system bases 30% of the score on debt to available credit, and some financial experts are calling on FICO to amend this ratio due to the “no-fault” nature of these shrinking credit lines.

FICO, however, is not budging. They say that the consumers who have been affected by this arbitrary reduction in available credit are holding their own. They’re able to raise their scores fairly rapidly after the dip by paying off existing balances and discontinuing use of their credit cards.

Card holders can expect to see this trend continuing into mid-2010, when new regulations limiting card issuers actions will take effect.

Right now, they are able to change your credit limit and your interest rate for any reason – or for no reason. They can also change your payment date, causing you to receive your statement too late to make an on-time payment.

When the new regulations go into effect, card issuers will be required to give 45 days notice before making such changes, and will be prevented from increasing the interest rate on current balances. They’ll also have to send your statement 3 weeks before the due date and will be prevented from charging you a late fee if your payment was postmarked 7 days ahead of the due date.

In the meantime, do read every message that comes from your credit card company, do read your statement each time it arrives, and do go check your account on line before setting out to make a purchase. Your $10,000 credit limit on which you owe $560 may have shriveled to a $500 credit limit since your last statement. It’s best to learn that kind of news at home rather than when you’re standing at a check out counter.

If your card issuer has done this to you, you may be tempted to tell them to keep their darned card. But that’s not wise. Do transfer your balance to a friendlier lender, but keep the account open. Even with a lower credit limit, the credit it represents will help keep your credit score from falling even further.

Author:Marte Cliff

Posted in FICO | Comments Off

Friday, April 18th, 2008

FHA loans are loans that are insured by (HUD) Housing Urban and Development. FHA loans have been around since the 1930’s right after the “Great Depression.” This was when 4 out of 10 households owned a home. (FHA) Federal Housing Administration is the savior for our current market just like it was back during the roaring 30’s.With FHA loans especially during a credit crunch like we are currently are in, you can rest assure banks are willing to be more lenient to approve credit challenged borrowers with FHA financing. The reason is FHA loans are insured by HUD, and if the borrower looses the home HUD will pay a claim to lender for the loss. FHA is the largest single insurer of loans in the world. FHA loans are loans that are insured by (HUD) Housing Urban and Development. FHA loans have been around since the 1930’s right after the “Great Depression.” This was when 4 out of 10 households owned a home. (FHA) Federal Housing Administration is the savior for our current market just like it was back during the roaring 30’s.With FHA loans especially during a credit crunch like we are currently are in, you can rest assure banks are willing to be more lenient to approve credit challenged borrowers with FHA financing. The reason is FHA loans are insured by HUD, and if the borrower looses the home HUD will pay a claim to lender for the loss. FHA is the largest single insurer of loans in the world.

FHA Advantages.

• Lower interest rates, typically interest rates are lower on FHA loans with the banks since they are government insured loans

• Only requires minimum investment from borrower of 3% down payment, which can be eliminated by Down Payment Assistance. So essential you can get a 100% financing with FHA loans. Note: Requires Seller participation

• If you have less than perfect credit you can typically can get a loan with FHA, they usually like to see 12 to 24 months clean credit report history. You can even get a loan while in chapter 13 bankruptcy.

• No Credit Score Requirement

• Recent loan limits increased-varies from state to state; go here to find out. For example you can buy a home in the state of Texas with FHA up to $271,050. Depending on if your state is a high cost area; obviously this loan limit would be higher.

• Will allow alternate lines of credit if not good history is on credit report.

Example:

1. Letter from any utility company stating you have been on-time with your payment history for that last 12 months.

2. 12 month payment history from car insurance company, cell phone company and even daycare will work.

If you are currently in the market to buy or maybe you feel like you need credit repair, what ever your direction is, getting a FHA loan is not as hard as you think. FHA gets people approved that may not get approved with other loan types. The first step is to examine where you are at with a lender and get the ball rolling. IN this current market some lenders are requiring you to either have a 580 credit score or higher. They will also allow no credit score but your interest rate is higher than current market rates. This is going on even though FHA has no credit score requirement; this is due to bad performance of loans below the credit score benchmark of 580.

CreditScoreQuick.com

Posted in FICO, fha, fico score, free credit score reports | Comments Off

Monday, March 24th, 2008

What is the current Crisis What is the current Crisis

Over the last 10 years our country went through a real estate boom. There were three categories of loans being provided. The first was Prime, the second was Alt a, and the third was Sub-Prime loans. Typically any loan less than Prime had higher rates because of the risk of the borrower. The Sub prime loan was a creative loan that was provided and is currently the reason for around 46% of foreclosures in the U.S. This is astonishing if you think about it, and is the cause for a downturn in our economy. When you have this type of debt being wrote off, someone is affected. That is why our banking industry has had a liquidity problem. There were more loans being bought back than there was cash in the bank.

Insight on reason for foreclosures

Most of the mortgages given during this real estate boom that were Sub-Prime were adjustable rate mortgages (ARM). This type of loan looked very attractive with its initial “low teaser rates”, which typically expired after 2 years. Most of these loans were set to reset between 2 to 5 years which would cause the payment to increase dramatically. The selling point on these loans over the years was, if you keep your credit rating good you can refinance your ARM loan into a 30yr fixed mortgage once the ARM reset. Unfortunately with the declining property values and the tightening up on underwriting guideline it has made it impossible to refinance these types of loans. The result is the mortgage payment will increase dramatically and a foreclosure to follow afterward s. Since all of this has taken place we are seeing global implications on foreign investors that might have put there stock in Mortgage backed securities. IN other words investors global wide are pulling there interest out of these types of loans. Since the book is still being written on this crisis we anticipate the overall economy to feel the strain of this unfortunate crisis and for ARM loans to be less common in the future.

What can I do about my current ARM loan?

Here are the steps in regards to determining whether you can refinance your current loan.

* Determine if you have the current credit to refinance into a FHA loan.

* Determine if you have the equity to refinance your current mortgage

* Call your loan officer to determine if they can help you

If you feel you are not going to be able to afford your mortgage payment, call your lender before you are late on payments. Make arrangements with them rather than not notify them at all. If you find that your lender will not work with you there are counselors that you can talk to.

Here is a list:

Hope Now

An alliance between counselors (HUD approved), servicers and investors that strives to keep homeowners in their homes by helping them renegotiate their loans.http://www.hopenow.com/

Homeownership Preservation Foundation

A nonprofit that creates partnerships with local governments, nonprofit organizations, borrowers and lenders to help families overcome obstacles that could result in the loss of their homes. http://www.995hope.org/

Counseling Agencies Approved by HUD Developments

The U.S. Department of Housing and Urban Development (HUD) sponsors housing counseling agencies throughout the country that can provide advice on buying a home, renting, defaults, foreclosures, credit issues, and reverse mortgages. http://www.hud.gov/offices/hsg/sfh/hcc/hcs.cfm

NeighborWorks Center for Foreclosure Solutions

Works to preserve homeownership in the face of rising foreclosure rates. http://www.nw.org/

Financial Education/Assistance

My Money Management

A collaborative effort by the financial services industry to provide consumers with access to financial education to help inform their personal finance decision process.http://www.mymoneymanagement.net/

FHASecure plan

A refinancing option that gives credit-worthy homeowners, who were making timely mortgage payments before their loans reset but are now in default, a second chance with a FHA insured loan product. http://portal.hud.gov/

Here are some helpful tips for avoiding foreclosure from U.S. Housing and Urban Development.

CreditScoreQuick.com

Posted in ARM, FICO, foreclosure, free credit report, free credit score reports | Comments Off

Wednesday, March 19th, 2008

A credit score is a number that reflects your creditworthiness at any given time. Typically the higher your score the better your credit. Individuals with higher credit scores typically can obtain mortgages, credit cards, loans and insurance with better terms. The lower your score the worse your terms are on any offer. The Credit Score is based on the information stored with in your credit report.

Each Bureau has its own score

Each Bureau has its own name for the FICO® Score.

Equifax – Beacon

TransUnion – FICO Classic

Experian – FICO Risk Model

The general scoring ranges between 300 – 850. Fair Isaac divides the scores into five categories.

780 – 850 – Low Risk

740 – 780 – Medium – Low Risk

689 – 740 Medium Risk

620 – 690 – Medium High Risk

620 – and Below – High Risk or “sub-prime.”

A credit score can change quickly for several reasons, including late payment or big increases in credit card balances. Each credit bureau may not have identical information about you, in large part because some creditors only report to one or two bureaus instead of all 3. This results in different credit scores amongst the credit bureaus. Some insurers and creditors use there own formula to calculate score in conjunction with the FICO score model. For example one lender might emphasize more on payment history within the credit report, where another lender might focus on something totally different within your report. A credit score itself might be the determining factor of better rates and terms with other creditors. But in the insurance context, the “credit-based insurance score, “typically is on of the many factors determining whether a policy is underwritten or at what premium. Most lenders and insurance companies scan your credit report for derogatory terms like bankruptcy, judgments, foreclosures, and collections.

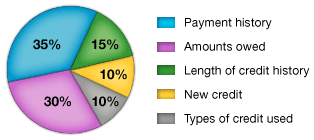

How is a credit score calculated?

Factor 1: Payment History (35%)

Factor 2: Amount Owed – Extent of Indebtedness (30%)

Factor 3: Length of Credit History – The Longer, The Better (15%)

Factor 4: How Much New Credit? (10%)

Factor 5: Type of Credit (10%)

CreditScoreQuick.com

Posted in FICO, credit report, free credit report, free credit score reports | Comments Off

Wednesday, March 5th, 2008

The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected. The home buying process can be tricky at times. There are definitely some things you need to avoid during this process. I have seen all kinds of nightmares because someone did not listen to their loan officer. I will give some you exactly what not do in this articles so your loan and credit score is not affected.

Late payments

During the home buying process make absolute sure you are not late on anything. If you have a late payment on anything that reports to your credit report your credit score will be affected. In return an underwriter will see this and your loan could be dead as a result. Late payments on any obligations that reports to your credit report will drop your score between 100 to 150 points. “Don’t be late on anything.”

Don’t buy anything on Credit

While you are going through the home buying process you don’t want to take on anymore debt, this could affect your loan. That means don’t go out and put furniture on credit for your new home until you have closed and funded on the loan. Don’t put anything on credit period.

Don’t co-sign on a loan for anyone

While you are in the process of getting a loan, don’t co-sign on any note. This could cause your loan to get denied. When you co-sign on a loan, then you are equally responsible for the new obligation. This could lower your credit score, and also cause income to debt ratio problems as well.

Don’t quit your JOB

Ok, you might think this is a joke, but we have actually had borrowers quit their job thinking we would not find out. Well, guess what we will. Don’t quit your job during the home buying process; underwriters do last minute job verifications before loan documents go out to the title company for a closing.

I hope this has been advice you got prior to doing any of the above. You could definitely have some major problems. Maybe you have not even started the loan process, and this will be good advice for you. What ever your situation is, make sure you are on top of your credit report and scores. Your credit scores could be affected by any of the topics discussed in the article.

CreditScoreQuick.com

Posted in FICO, free credit score reports | Comments Off

Tuesday, March 4th, 2008

Buying a home is the single biggest purchase you will ever make. Surely you want to make sure it s a smooth process. We are a society that likes to touch and feel. Kind of like trying to buy a car, you want to take it for a test spin before you buy. Unfortunately that is not the way it works in the real estate arena. You will find that most “seasoned real estate” professionals will not jump in their car to show you a home until you have secured financing with at reputable lender. With the current credit crunch and liquidity problems with banks, you better make darn sure you can secure financing. Even individuals with good credit are having issues getting financing secured. Here are the steps to follow: Buying a home is the single biggest purchase you will ever make. Surely you want to make sure it s a smooth process. We are a society that likes to touch and feel. Kind of like trying to buy a car, you want to take it for a test spin before you buy. Unfortunately that is not the way it works in the real estate arena. You will find that most “seasoned real estate” professionals will not jump in their car to show you a home until you have secured financing with at reputable lender. With the current credit crunch and liquidity problems with banks, you better make darn sure you can secure financing. Even individuals with good credit are having issues getting financing secured. Here are the steps to follow:

Get Pre-Approved not Pre-qualified.

Getting pre-approved means you have a lender verify all documents to support the loan approval. Most lenders will run you loan through a automated engine. Once everything is verified and ran through either Fannie Mae or Freddie Mac engine you should be approved at that time.Pre-qualfied means that someone has taken your information over the phone and has not verified anything other than your credit report. This type of approval does not mean jack hill of beans.

Meet with your lender whom has approved you.

This is an important part of the process, so there is no misunderstanding on loan terms. Make sure you understand your payment interest rate etc………..

Find a reputable and seasoned Realtor.

Finding a seasoned reputable Realtor is so important; the reason is they need to understand the current market, and what to look out for on your behalf. A Realtor job is to look out for your best interest. Once you have been pre-approved, then the Realtor will have a better understand as too what type of negotiation process to start on a home.

This process is the best way to assure your home buying process is as smooth as possible. I am sure you hear of the nightmares out there, typically this is because the proper process in not followed. The end result is not good one. Lenders are looking at your credit scores very close now. Make sure before you start the process you pull a current copy of your credit report. That way you already have a idea where you stand.

Author: Mike Clover

Posted in FICO, free credit score reports | Comments Off

Wednesday, February 27th, 2008

Could your credit report be a racist report? We all know racism is a problem in the U.S., but of course no one wants to admit it. Is it possible that when calculating your credit score your result was lower because of the color of your skin, or because of your sex? Do the Credit Bureaus even know what race you are, or your sex? These are some interesting questions that need to be answered in this article. The following does not determine your credit score according to MyFICO. MyFICO is the inventor of the FICO score that 90% of banks use to determine your creditworthiness.

The following does not determine your credit:

- Race, Color, Religion, national origin, sex and martial status

- your age

- Your salary, occupation, title, employer, date employed or employment history

- Where you live

- Interest rates currently being charged on any account

- Any items reported as child/family support obligations or rental agreements.

- Whether or not you are participating in a credit counseling of any kind.

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Certain types of inquiries (requests for your credit report).

US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act. It is good to know that your credit report is calculated on other factors.

Below is a good example of how your credit score is calculated.

Now you can see how credit reports are not predjustice, they calculate your credit based on the information provided in the pie chart above.

Don’t forget to learn what creditors already know. If you are in the market to make a purchase you might consider getting your free credit score report. That way you know what they will find out.

CreditScoreQuick.com

Posted in FICO, free credit report, free credit score reports | Comments Off

Monday, January 28th, 2008

Have you thought about getting a copy of your Credit Report? Years ago there were complaints that credit reports were hard to read for the consumer. In past years Equifax, Experian and Trans Union had changed the format of the reports to make them more readable and understandable. Each of the 3 Credit Reporting Agencies or ( CRAs) have ways of referencing a credit report with them.

For Instance:

Equifax – Confirmation number

Experian – Report Number

Trans Union – File Number

These particular reference numbers will be asked if you are disputing any of these credit bureaus.

To make matters more difficult, “Credit Report” is not the official term. The Fair Credit Reporting Act calls the credit report for consumers “Consumer Report.” The industry refers to the report that creditors sell as “credit report.” Nether less either one has the same purpose. They give an account of your personal credit history with creditors.

Here is an example of what you need to identity you with all 3 Bureaus.

First Name:_______ Middle Name:________ Last Name:_______

Birth date:_______ Social Security Number:________

Current Address: Typically two year residence history

Current Employer: ________

Here is what to expect to see on your credit report.

1. Your identifying information listed above:

2. Your Payment history, including auto payments, credit card payments, installment loans, and mortgage history.

3. Public Records: bankruptcies, tax or other liens, and judgments.

4. Inquires showing which companies accessed your credit report for different purposes.

Identity Information

This information is very important, and needs to be accurate. The CRAs use your personal information to determine which report to route your information. If you input the wrong information when getting your credit report, it can lead a report that results in mixed files, and other inaccuracies. This definitely pertains to inputting the correct social security numbers. Maybe you are a JR, and your information is getting mixed with your father or son. Believe it or not this is a common problem with credit reports. You may have to dispute this information with the CRA that is reporting incorrectly.

Credit History

A bankruptcy can remain on your credit report for 10 years; other negative information typically is on there for 7 years unless you can get the creditor to give you a letter to delete a negative item from the CRAs. A tax lien that is not paid can stay on your report for ever. Once you pay it, from the paid date it stays on your report for 7 years. Here are terms and there meaning as they are listed on your report.

Public Records: Bankruptcies, court and default judgments, liens, and foreclosures

Late Payments: Typically falls into one of the four categories, 30 day late, 60 day late, 90 day late, and 120 day late.

Charge Offs: Accounts that are in default of original contract and terms. Charge off is a book keeping term which means the creditor reports obligations as a loss.

Collections: A account that is so delinquent that the obligation is turned over to a collection company for collection.

Typically after all the bad is listed, the report will list all the accounts in good standing. Experian and Trans Union reports “never late”, and Equifax reports as “pays as agreed.”

You will want to always make sure all information is accurate.

Inquiries

Any time someone checks your credit for loan, credit card, installment loan or a mortgage you will have on of two types of inquiries: “hard” and “soft.” Soft inquiries don’t drop your credit score, but too many hard inquiries you could drop your score.

Account History Status Codes

Equifax report will list codes showing how you are classified when you do not pay your bills on time. Also a credit report will show types of credit, “I” for installment loan, “R” for revolving and “M” for mortgage. Here are numeric codes as well.

1: On Time

2: 30-59 Days Past Due

3: 60-89 Days Past Due

4: 90-119 Days Past Due

5: Over 120 Days Past Due

7: Included in Wage Earner Plan

8: Repossession

9: Charge Off

Blank: No Data Available for that month

0: Unrated

Description of Accounts

Date Account Closed

Date Account Opened

Company Name – The Creditor

Account Number

High Credit

Credit Limit

Terms of payments 360 months or 30 yrs

Number of months reviewed

Date Reported

Balance

Past Due Date

Activity

Date of Last Activity

Charge Off Amount

Deferred Payment Date

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, Internet identity theft software, secure credit cards, and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in FICO, credit report, credit worthy, establish credit, free credit score reports | Comments Off

Monday, January 21st, 2008

If you are a first time home buyer, you more than likely don’t know what the process is. Most first time home buyers rely on a real estate agent to guide them a long. Here is the advice and tips that will make your home buying experience a good one.

First Step:

1. Find out what you qualify for. This is the most important part of the home buying process whether you are a first time home buyer, or someone upgrading to a bigger home. We know that getting the approval process done first is not as fun as looking at homes. But you could be wasting your time and everyone involved by not getting your finances in place first. I would recommend getting a current copy of your credit report with scores before calling a lender. Make sure you know your credit situation, so you are an educated home buyer.

Second Step:

2. Find a seasoned realtor that knows what they are doing. There are too many realtors in the real estate business that don’t have a clue when trying to find you a home. I would get a recommendation from you lender. They typically know who will get the job done for you. You don’t have to buy a home with a realtor that works for some big name brokerage. There are plenty of good realtors that work for small companies as well. Do some research?

Third Step:

3. Once you have secured financing with a reputable lender and have found a seasoned realtor, then you are ready to start the looking process. If a realtor takes you out and only wants to show you 4 to 5 homes and that is it, this is a sign that all they are interested in is a commission check. This is the biggest purchase of your life, it usually takes all day to look at homes and then make a decision. In some instances there may only be 4 to 5 homes to look because that is all that is available that meets your criteria. I am sure you get the idea though.

Fourth Step:

4. Close on your new home. Hopefully you have made the right decisions and got reputable and honest real estate professionals to make it happen for you.

Conclusion: Make sure you can buy first, and what type of loan you qualify for. This is essential so you will not be disappointed. You should also have selected seasoned and professional real estate service providers. Remember you are relying on real estate professionals to help you make the biggest purchase of your life.

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, Internet identity theft software, secure credit cards, and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in FICO, credit cards, credit report, free credit score reports | Comments Off

Monday, January 21st, 2008

Have you ever wondered what does not affect your credit score and credit report? There are factors that Fair Isaac doesn’t use in determining your credit risk. Fair Isaac says its scoring model complies with the Equal Credit Opportunity Act prohibiting against using racial or ethic data in credit decisioning. They also have said that based on independent research, it has shown that the credit scoring is not unfair to minorities or people with little credit history. The scoring model has been a consistent and accurate measure of repayment for all people who have credit history. So in other words, your ethnic background has nothing to do with a given credit score.

In a different perspective of the model, credit scoring can be a disadvantage for people who are not familiar with the system. For example individuals who are poor and low-income usually don’t have great mobility. They typically utilize local stores and credit grantors within there communities. Since most of these grantors tend to be small, they usually don’t report to the Credit Bureaus. With this in mind, this class of people tends to suffer the most because of the limited access to big banks and companies that report to all agencies.

Here is what Fair Isaac does not consider:

* Race, Color, religion, national origin, sex, or martial status.

* Age

* Salary, Title, Occupation, employer, date employed, or employment history

* Place of residence

* Any interest rate being charged on credit card account or other account

* Any items reported as Child/Family support obligations or rental agreements

* Certain types of inquiries ( Certain requests for your credit report or credit score)

* Any information not found in your credit report

* Any information that is not proven to be predictive of future credit performance.

Since there is so much information out there about what determines your credit score on your credit report, we figured we would give you a different perspective in this article.

CreditScoreQuick.com

Posted in FICO, credit report, free credit score reports | Comments Off

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|