If you have no credit scores due to being new to the credit arena or you have just been a cash person all your life there is hope for you. There is one sure way to get the credit score calculated in about 4 to 5 months. In this article I will talk about how to establish good credit scores for a healthy credit report.

Secured Credit Cards

A lot of people don’t know this but secured credit cards are the quickest way to establish credit. The reason for this is you give the bank money to secure credit that reports to all 3 credit bureaus. Typically you need about two cards to get the ball rolling. After 4 to 5 months of reporting “bam” you have credit scores. Typically creditors like to see 3 lines of credit reporting for a minimum of 12 months with good payment history. With this type of activity on your credit report, reporting to Experian, TransUnion and Equifax is one of the recipes for success. You will not achieve credit scores if you can not get someone to extend credit to you. That is the secret behind applying for a secured credit card to start the road to establishing this wonderful three digit life altering number.

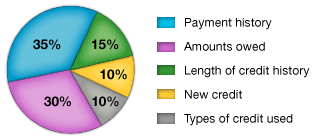

Here is an example of a mix of credit that Fair Isaacs scoring model uses to determine your risk which ultimately determines your scores.

Buy a house

Once you have about 12 months of rental history, with paying your utilities, and your secured credit cards on-time you will be able to buy a house. Of course you need to qualify for a loan with your current income. Getting a house is not as hard as one might think. If you have a two year work history and have 3 lines of credit like I mentioned earlier you can buy a home. Typically the type of loan you will qualify for is FHA. This is a great first time buyers program. Buying a house will help you get a mix of credit reporting on your credit report. This is around 10% of your overall score. When creditors extend credit to you they like to see that you own a home as opposed to renting.

Keep Credit Card Balances low.

Once you have got secured credit cards reporting on your credit report make sure you keep the balances below 30% of a your secure credit amount.

Example:

Secured Amount: $300.00

Balance at 30%: $90.00

This will keep your scores where they need to be once you establish them. After about 6 to 12 months you can request a limit increase. This is another sure way to increase your credit scores.

Get a car Loan.

Getting a car is actually easier than getting just about any other credit. There are all types of lenders out there willing to loan you money on a car loan. You might try getting a loan for a car to establish credit as well. Most car lenders report the note to all 3 credit bureaus. This is another way to get your scores rolling as well. Make sure it’s not some small tote the note establishment that does not report to the bureaus. Make sure the loan is reported to all 3 credit bureaus.

Conclusion: If you follow this advice you will be well in your way to establishing your credit scores. If you are unsure if you have scores get a copy of your free credit reporttoday.

CreditScoreQuick.com