A friend called the other day to tell me that their loan modification had been rejected. After several months of paperwork and the destruction of their credit scores, the bank decided that they couldn’t afford the lower payment.

What? Until they got involved with loan modification they had been keeping up with the higher payment. They didn’t get a black mark on their credit report until the loss mitigation people instructed them to miss a payment.

They, like so many others, simply got involved in loan modification because their diminished income was making it hard. They work in real estate sales, and the market in their area has been dismal. They hoped that a lower payment for 5 years would ease the strain until the economy finally turns around.

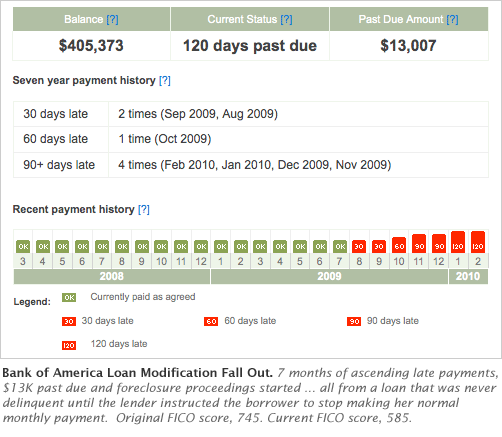

Now, after a few months of making the modified payment, their credit report shows 30, 60, and 90 day late payments – because the amount they’d been paying was less than their original contractual agreement.

Congresswoman Jackie Speier thinks this needs to change. On July 15 she introduced a bill entitled the “Protecting Homeowner’s Credit History Act.”

This bill, HR 5743, calls for an amendment to the Fair Credit Reporting Act. If passed, it would prohibit lenders from furnishing negative loan modification information to the credit reporting agencies, and would prohibit that information from being used to compute a consumer’s credit score.

But does the fault lie with the reporting agencies?

No, it lies with the HAMP system and what they choose to report.

If loan modifications were being processed in a timely fashion – such as 30 days – there would be no impact on the borrower’s credit scores. Instead, lenders are taking as long as 9 months to process loan modifications and make their decisions.

Plus, if the bank makes a temporary agreement with the homeowner during the modification trial period, that should be the agreement on which the report is based. Paying as agreed on the temporary agreement should show on a credit report as “paid as agreed.”

Some experts say that loan modification should affect a borrower’s credit scores. Their premise is that people who modify their loans are more likely to default in the future. Of course, this hasn’t been going on long enough to have any solid research to back that presumption.

People who are determined to keep their homes do what they need to do to hang on. Therefore, many are making payments that an underwriter would say they “can’t afford.” To take it to the next step and deny modification by deciding that the homeowner who has been making a $3,000 payment without fail suddenly won’t qualify to make an $1,800 payment is nothing short of ridiculous.

Two things need to happen to the HAMP program, which has helped only about 10% of the homeowners it was supposed to have helped by last June. First, lenders must be required to process applications within 30 days Then they need to start using common sense in making their decisions.

Author: Mike Clover

CreditScoreQuick.com